- Yacht Insurance

- Boat Insurance

- Megayacht Insurance

- Jetski Insurance

- Floating Home Insurance

- Rib-Boat Insurance

- Application Online

- Ext. 3rd-Party Insurance for Skippers

- Professional Skipper Liability Insurance

- Deposit Insurance for Chartered Yachts

- Travel Cancellation Expenses Insurance

- Charter Price Contingency Insurance

- SeaHelp CharterPass

- Acting in case of damage

- Yacht registration

- Cobblestone GPS Tracker

- EIS bonus-programme

- International

- Contact form

Take advantage of our attractive deposit insurance for Skipper and Crew. It is easy to forget that a chartered yacht is not our own among the fun and freedom a cruise on dream waters evokes. Understandably, the yacht owner secures themself against unpleasant surprises and charges a deposit. Whether it's a sail breaking, the yacht gets a few scratches, or the slightest damage after your return from the dream vacation, the owner will partly or wholly retain this deposit. In this case, you are protected by charter deposit insurance.

Details for the charter deposit insurance

It is covered in the partial or total withholding of the charter deposit by the owner/charterer due to loss or damage caused by the private policyholder or the crew. Insurance benefit: The compensation of the damage in money does not exceed the insurance sum. The deductible is 10 % of the deposit, at least 100 EUR. If the regatta risk is included, the deductible is 15 % of the deposit, at least 300 EUR.

Simple pricing model

To determine the insurance premium for our charter deposit insurance, only two questions are necessary:

- Is it covered for a voyage or an annual coverage?

- How much is the deposit sum? (for an annual coverage the most expensive planned deposit sum)

| Cover for a cruise | Annual coverage | |

| Deposit of up to 3.000 € | 8 % | 15 % |

| Deposit of more than 3.000 € | 7 % | 13 % |

| Minimum premium | 75,- € | 100,- € |

| Regatta risk | plus 15 % | plus 15 % |

We also charge a one-off policy fee of 15,00 EUR including the statutory insurance tax.

Sample calculation:

A voyage with a deposit of 2.750 € without regatta risk: 2.750,- € x 0,08 = 220,- € The insurance premium to be paid is 220,- €. If the regatta risk shall be included, the following calculation is valid: 2.750,- € x 0,08 x 1,15 = 253,- € A voyage with a deposit of 900 € without regatta risk: 900,- € x 0,08 = 72,- € The calculated premium is below the minimum premium. That's why the bonus is 75,- € .

For yacht and boat

- Boots Insurance

- Floaat Boat Insurance

- Rib-Boot Versicherung

- Megayacht Insurances

- EIS Charter Seal

- free Iridium messaging

For Skipper & Crew

- Skipper & Crew Versicherungspakete

- Travel Health Insurance

EIS - European Insurance & Services GmbH Scharfe Lanke 109-131 D-13595 Berlin Fon: +49 (0)30 214 082 -0 Mo.-Fr.: 9:00 - 18:00 [email protected]

- Data protection

The Essential Guide to Yacht Charter Insurance

- by yachtman

- September 19, 2023 June 22, 2024

Yacht charter insurance is a must-have for any yacht owner! Get all the info you need to know with this guide . Understand the basics. Whether you own a boat or are chartering one, insurance coverage is a must to protect your investment and give you peace of mind. This guide dives into the different aspects of yacht charter insurance, like what it covers and why it’s important . Plus, unique details like liability coverage, weather protection, and coverage for personal belongings . Don’t miss out on the chance to protect yourself and your investment. Get comprehensive yacht charter insurance and sail with confidence. Accidents can happen. Without proper coverage, you could face big losses . Don’t let fear stop you from enjoying yachting. Get insurance to sail worry-free.

Understanding Yacht Charter Insurance

To understand yacht charter insurance, navigate through the sub-sections: What is yacht charter insurance? Discover its importance as we explore the benefits it provides.

What is yacht charter insurance?

Yacht charter insurance is essential for yacht owners and companies. It gives coverage for risks and liabilities that may come up during a charter. Hull and machinery coverage guards against physical damage to the yacht from accidents or storms. Liability coverage protects against claims from others, like their injury or property damage. Crew liability coverage also ensures protection for crew members if they get hurt working on the yacht.

It’s possible to customize yacht charter insurance policies depending on the yacht size, value, cruising spots, and possible risks. An experienced marine insurance broker can help decide the ideal coverage. 95% of private yachts offered for charter have comprehensive yacht charter insurance . So, it’s necessary and common in the industry to get proper insurance coverage.

Why is yacht charter insurance important?

Yacht charter insurance is essential. It safeguards you against potential risks and damages. Accidents, theft, or damage to the yacht – all covered! You won’t have to worry about the financial burden of liability claims. Plus, it allows for flexibility. Choose from various coverage options to ensure adequate protection.

To make the most of it, assess your needs and determine the level of coverage. Review the terms and conditions before making a decision. Get help from an agent or broker if needed. Lastly, take preventative measures for safety. This will demonstrate responsible behavior to insurers. Enjoy your charter with peace of mind!

Types of Yacht Charter Insurance

To ensure the safety and protection of your yacht charter experience, understanding the types of yacht charter insurance is essential. Explore the solutions offered by liability insurance, hull insurance, and personal accident insurance. Each sub-section will provide valuable insights into their respective coverage and benefits.

Liability insurance

Check out this table summarizing the main points of liability insurance :

| Insurance Coverage | Description |

|---|---|

| Bodily Injury | Covers medical expenses and lost wages |

| Property Damage | Pays for repair costs of damaged property |

| Personal Liability | Shields against lawsuits and legal expenses |

| Pollution Liability | Takes care of cleanup costs of fuel spills |

Plus, you may find other provisions in the policy, such as salvage and wreckage removal, collision liability, and terrorism coverage. So, it’s essential to evaluate individual needs before buying insurance.

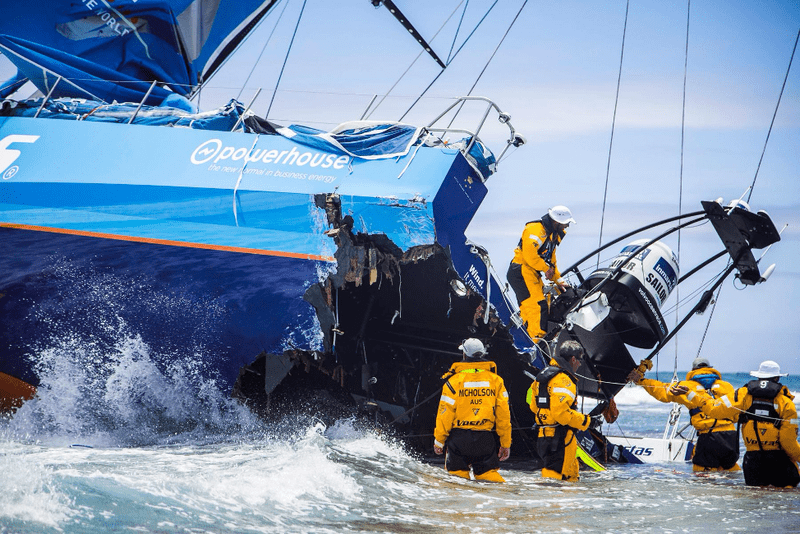

This all came to the forefront after a devastating yacht charter accident that left property damage and injuries. It showed the importance of having the right cover to protect the owner and charterers from such unpredictable events. Ever since, liability insurance has become an essential part of yacht charters around the globe .

Hull insurance

Hull insurance is important to safeguard your yacht. Here are the key aspects to know:

Coverage: It covers damages or losses to the vessel, machinery and equipment, plus personal property onboard.

Perils: Fire, storms, theft, vandalism, natural disasters like earthquakes – all covered.

Agreed value: In case of a total loss, the insured amount will be paid out without deductions.

Deductibles: Policyholders must pay a deductible before receiving any reimbursement for their claims. Size varies.

Claims process: Evidence and incident details must be provided. Report any incident promptly.

Let’s take a real-life example to show the importance of hull insurance. In July 2020, a yacht was damaged by rough weather. The hull and machinery were damaged. The owner had an extensive insurance policy so all repair costs were covered. Unexpected events can happen at any time, so comprehensive insurance is key.

Personal accident insurance

Personal accident insurance offers financial protection in the event of accidental bodily injury or death for the insured person and crew members/guests. It may cover medical expenses such as hospital stays, surgeries, medication, and rehabilitation costs. In addition, a benefit is offered in case of permanent total disability or loss of limbs.

It’s important to note that coverage may vary according to the specific policy terms and conditions. Thus, it is crucial to review the policy details before deciding.

To illustrate the importance of personal accident insurance, consider a true story. A passenger fell overboard on a yacht charter and was injured. Thanks to their personal accident insurance, medical attention was received without worrying about bills. This shows the essentiality of having suitable personal accident insurance while chartering yachts.

Choosing the Right Yacht Charter Insurance

To ensure you select the perfect yacht charter insurance, equip yourself with the following essential knowledge. Assess your needs, consider coverage options, and research insurance providers. These steps will guide you towards making an informed decision, safeguarding your yacht charter experience from potential risks.

Assessing your needs

Before anything else, understand the size and type of yacht you’re chartering. Insurance needs differ according to yacht specs and value. Also think about where you’re cruising and how you’ll use the yacht. This will help you choose the best coverage.

Evaluate how long you’re chartering for too. Short-term or long-term, having the right insurance is key to protect against unexpected events or damage.

Inspect your personal belongings on board. Electronics, jewelry, artwork, special equipment – these may need extra coverage or higher limits.

Take this true story as an example. A couple chartered a sailboat without carefully assessing their insurance. Then they encountered a storm and the vessel and personal belongings were damaged. Without insurance, they had to pay for all repairs, leading to stress and serious financial burden.

So, assess your needs when picking yacht charter insurance. Look at yacht specs, cruising area, duration of charter, and the value of personal belongings. With the right coverage, you can sail worry-free and enjoy a safe journey on the open seas.

Considering coverage options

It’s essential to examine coverage options before choosing yacht charter insurance. That way you’re sure to have protection against any risks and liabilities.

Take a closer look at the coverage options:

- Liability Insurance : Covers third-party bodily injury and property damage claims.

- Hull Insurance : Protects the yacht from physical damage.

- Medical Insurance : Covers medical costs for injuries on the yacht.

- Personal Property Coverage : Covers loss or damage to personal belongings onboard.

These coverage options ensure your investment is secure and you have peace of mind on your yacht charter.

Plus, you can customize your policy to fit your needs. For example, include coverage for water sports equipment or increase liability protection.

Pro Tip: Review the terms, exclusions, deductibles and premium rates. Make sure they fit your budget and meet your requirements.

Researching insurance providers

Creating a table with key information can help to compare insurance providers. Columns should include the name of the insurer, types of coverage, premiums and deductibles, and any benefits or services. This makes comparison easier.

When researching, consider unique details. Some companies may specialize in yacht charter insurance. Others may offer extra services such as 24/7 assistance or personalized support.

Get suggestions from those with experience in the yachting industry. Recommendations from others, plus online reviews and testimonials, provide valuable insights.

These suggestions give more perspectives and experiences to consider. Tap into the collective wisdom of those who have already navigated similar decisions. Incorporate these into research to gather comprehensive info and make a well-informed choice for yacht charter insurance.

Applying for Yacht Charter Insurance

To simplify the process of applying for yacht charter insurance with the sub-sections of gathering necessary information, filling out the application, and reviewing and submitting the application.

Gathering necessary information

Gathering the essential info for yacht charter insurance is vital for a seamless experience. Here’s a list of details to collect before applying:

| 1. Personal Information: | Full name, contact info, address |

| 2. Vessel Details: | Type, model, year of build |

| 3. Usage and Navigation: | Areas of operation, use |

| 4. Crew Credentials: | Certs, experience |

Besides, it’s important to provide exact paperwork such as registration papers, surveys, maintenance records, and safety equipment inventory. These details help insurers assess the risk attached to your yacht and decide the right coverage.

Interestingly, gathering information for yacht charter insurance has changed. In the past, it was a lengthy process with paper forms and long correspondence. However, with the tech development and digitalization of insurance processes, it has become much simpler and hassle-free.

Filling out the application

Fill in your full name, contact info & address. Mention any boating experience or certifications.

Specify yacht make, model & year. State any modifications or extra equipment.

Outline how you will use the yacht. E.g. pleasure or commercial & if you will hire crew.

Choose coverage needed, e.g. hull damage, liability & theft insurance. Consider extra options like emergency assistance & medical coverage.

Be honest about past claims & attach documents to support your application.

Accuracy is key for comprehensive coverage.

Sail a chartered yacht in the Mediterranean & enjoy the sunset breeze. Indulge in gourmet cuisine prepared by onboard chef. An unforgettable vacation experience – with yacht charter insurance!

Reviewing and submitting the application

Always double-check the information! Carefully scan all sections of the application form, ensuring accuracy and completeness. Don’t forget to attach any necessary documents, like proofs of identification, yacht registration papers, and previous insurance details. Evaluate the coverage options provided by the insurer, including liability limits, deductibles, and additional endorsements. If you have doubts or need clarification, don’t hesitate to contact the insurer.

Before you submit, proofread the entire application for errors or inconsistencies. Then, submit the application through the designated channel. Add any specific requirements mentioned by the insurer. Maintaining professionalism while adhering to their guidelines is key. A boat owner experienced swift approval of their yacht charter insurance application within a day, showing how important it is to be meticulous!

Understanding the Policy Terms and Conditions

To better comprehend the policy terms and conditions in the essential guide to yacht charter insurance, equip yourself with an understanding of coverage limits and exclusions, deductibles and premiums, as well as renewal and cancellation policies. Dive into these sub-sections to navigate the intricacies of insurance within the context of yacht charters effectively.

Coverage limits and exclusions

Let’s have a peek at coverage limits and exclusions in a table format:

| Coverage Limits | Exclusions |

|---|---|

| Property Damage | Wear and tear |

| Personal Liability | Pre-existing conditions |

| Medical Expenses | Intentional acts |

| Loss of Use | War |

It’s vital to understand that these are just typical examples. Each insurance policy is distinct and you’ll need to examine your policy docs for precise info on these matters.

Apart from the table, there are other points to consider. Check if there are any sub-limits in each category. These sub-limits may limit the max amount payable for particular claims.

Here are some tips to get the most out of your insurance coverage:

- Carefully go through your policy: Have a look at all the terms and conditions in your policy document. Knowing what’s covered and what’s not will help you make wise decisions and dodge any shocks when filing a claim.

- Talk to your insurance provider: If you have any queries or need any changes, talk to your insurance provider for guidance. They can provide valuable advice and suggest other options if required.

- Look into extra endorsements: Based on your needs, you may want to think about adding endorsements or riders to increase your coverage. These extra provisions can give extra protection beyond what is generally provided in a standard policy.

By following these tips, you can make sure you get a comprehensive understanding of the coverage limits and exclusions in your insurance policy. Keep in mind, knowledge is power when it comes to insurance, so take the time to learn the terms and conditions to make informed decisions.

Deductibles and premiums

To understand deductibles and premiums, it’s important to know how they work. A deductible is the amount you must pay out of pocket, before insurance coverage kicks in. A premium is the regular payment for insurance coverage.

Here’s an example:

| Deductible | Premium |

|---|---|

| $500 | $100 |

If there’s a claim for $5,000 and the deductible is $500, you’d be responsible for the first $500. The premium of $100 is your regular payment for coverage.

Lower deductibles usually mean higher premiums, while higher deductibles lower premiums. So if you can pay more for claims, you can choose a higher deductible and pay lower premiums.

To make the most of deductibles and premiums:

- Check your finances: Look at emergency savings and monthly expenses before picking a deductible.

- Evaluate risk: Consider how much financial risk you can handle. If you have enough funds, a higher deductible may be better.

- Review your policy: Assess insurance needs and adjust deductibles and premiums. Changes in your life or assets may need you to change amounts.

By following these suggestions, you can pick deductibles and premiums that work for you.

Renewal and cancellation policies

Renewal and Cancellation Policies:

| Terms and Conditions | Renewal | Cancellation |

|---|---|---|

| Process | Automatic | Allowed anytime |

| Fees | None | Varies |

| Notice Period | 30 days | At any time |

Renewal means extending a policy for an extra term. Cancellation is ending a policy before it expires.

It’s essential to know that usually, renewal is automated . Also, you may cancel at any time during the policy period – though fees could apply.

Fun Fact: According to Insurance Journal, most policies don’t have penalties for cancellation within 30 days.

Managing Yacht Charter Insurance

To effectively manage yacht charter insurance, keep insurance documents organized, communicate with the insurance provider, and review and update coverage as needed. This ensures smooth operations and protects your investment.

Keeping insurance documents organized

Digitize your insurance docs! Scan them and create digital copies for easy storage and access. Label the digital files into categories like vessel docs, crew info, and policy details . Backup the data often onto storage devices or cloud services, to prevent data loss. It’s also recommended to use a document management system designed for insurance . Automatic categorization and reminders for policy renewals are features of these systems.

An incident happened – a yacht owner faced damage during a storm, and due to disorganized paperwork wasn’t able to file an insurance claim in time. He had difficulty locating his policy details and faced delays in compensation. This incident shows how important it is to organize yacht charter insurance .

Communicating with the insurance provider

Talking to your insurance provider is important. For a successful process, give clear details about your yacht charter and explain the type of insurance you need.

Specify the purpose of your yacht charter. Is it for leisure, business, or personal use ? This info helps the insurer understand what type of coverage is right for you.

Give details about the length of your charter and any restrictions. Like, if you’ll be sailing in foreign waters, or if there’s a limit on the navigation area.

It’s also wise to tell them how many passengers will be aboard. This affects the risk assessment and might affect the type of insurance, like liability insurance.

An example of how communication can help: A yacht charterer had an unexpected problem when their boat was damaged at sea. But thanks to their open communication with the insurance provider, they got quick help and a fast claims process.

Reviewing and updating coverage as needed

To guarantee protection, it’s essential to periodically review and update yacht charter insurance . Evaluate your policy’s limits and exclusions to identify any gaps. Check the yacht’s current value and make adjustments if needed. Changes in intended usage and cruising areas must be taken into consideration.

Leverage a specialized marine insurance broker for tailored recommendations. Ask about hull and machinery coverage, P&I, crew liability, passenger and crew personal accident coverages, as well as pollution liability .

Regularly review and update yacht charter insurance with help from an expert. This will guarantee the vessel is properly protected throughout its lifespan.

Yacht charter insurance is essential for a safe and successful sailing trip. Comprehending the specifics of this policy aids yacht owners in defending their investment and passengers from possible risks. For instance, Sailo.com states that yacht charter insurance usually guards against accidental damage, theft, liability claims, and medical costs for passengers . This comprehensive coverage provides assurance to yacht owners and those who rent their boats. So, before beginning your next voyage, be sure to get suitable yacht charter insurance to cruise the open seas fearlessly.

Frequently Asked Questions

FAQ 1: What is yacht charter insurance?

Yacht charter insurance is a specialized type of insurance that provides coverage for individuals or companies who rent or charter a yacht. It offers protection against various risks and liabilities that may arise during the charter period. Explore the ultimate yacht charter guide for more information.

FAQ 2: What does yacht charter insurance typically cover?

The essential guide to yacht charter booking process typically covers risks such as accidental damage to the yacht, theft or loss of personal belongings, liability for injury or damage caused to a third party, and expenses incurred due to cancellation or interruption of the charter trip.

FAQ 3: Do I need yacht charter insurance if I already have personal or boat insurance?

While personal or boat insurance may provide some coverage, it is important to check the policy details to ensure that it adequately covers the specific risks associated with yacht charters. Yacht charter insurance offers specialized coverage tailored to the unique needs of chartering a yacht.

FAQ 4: How much does yacht charter insurance cost?

The cost of yacht charter insurance depends on various factors such as the value of the yacht, the duration of the charter, the cruising area, and the coverage limits desired. It is best to obtain quotes from insurance providers to get an accurate idea of the cost.

FAQ 5: Is yacht charter insurance mandatory?

Yacht charter insurance requirements can vary depending on the charter company and the cruising area. Some companies may make it mandatory for charterers to have insurance, while others may offer it as an optional add-on. It is crucial to clarify the insurance requirements before chartering a yacht.

FAQ 6: How do I choose the right yacht charter insurance?

To choose the right yacht charter insurance, consider factors such as the coverage provided, the reputation and financial stability of the insurance provider, any additional services or benefits offered, and the price. It is advisable to compare multiple insurance options and read reviews before making a decision. For more information, check out Yacht Charter Regulations guide .

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

You are here :

Monday to Friday from 09:00 to 12:00 and from 13:00 to 17:00

- +49 (0) 89 /7467 34 90

- Latest news

Charter deposit insurance

Storms – full harbors – overcrowded bays. Damage to charter ships is becoming more and more frequent – the deposit is gone!

The solution: charter deposit insurance from YACHT-POOL!

Every experienced skipper knows how quickly the harmony of the crew is severely disrupted if damage is caused by him or a crew member and everyone is asked to pay. As united as the crew was before the start of the charter, they quickly disagree when everyone has to pay for the damage caused by just one person. This is usually the skipper himself – out of his responsibility as skipper.

As a responsible skipper, relieve your crew and yourself of these worries and enjoy a carefree cruise!

Naturally, this led to responsible skippers increasingly demanding insurance for this personal risk. YACHT-POOL’s security deposit insurance is not only valid for a specific charter week, but for a whole year without limitation – worldwide!

Because you can charter wherever you want, as often as you want, whichever ship you want and for as long as you want – worldwide!

In accordance with the YACHT-POOL conditions for deposit insurance, we will reimburse justified retentions of the deposit if they were caused by the skipper and/or the crew, up to the amount of the selected sum insured, which generally corresponds to the amount of the deductible of the hull insurance. If the amount of damage exceeds the excess, this must be paid by the owner’s comprehensive insurance. The retained deposit should therefore generally not exceed the excess of the comprehensive insurance. Please make sure that only justified retentions are deducted from your deposit!

Unjustified retentions apply to damage that was not caused by culpable action on the part of the skipper or his crew, but is due, for example, to defective construction or material fatigue, such as tearing of the forestay without external influence, tearing of shrouds or the anchor chain, etc. In such cases, please clarify with the charter company why you should be liable for damage for which you are not responsible and, if necessary, inform us of the reasons.

Act as if you were not insured and do not act recklessly. You are obliged to do so in accordance with the Insurance Contract Act. The insurance relationship is an internal legal relationship between you and the insurer. Do not argue this with the charter base, as it could be misunderstood and make your legitimate negotiating position more difficult “….because you are insured anyway”. In the event of lasting “misunderstandings”, this could lead to the exclusion of certain charter companies from insurance coverage in the long term. If damage claims that you cannot defend against are withheld from your deposit, obtain a receipt from the charter company and, if necessary, a corresponding repair invoice and send this receipt with a damage report signed by all crew members immediately after your arrival home. The policyholder named in the policy is entitled to receive the insurance benefit.

Make sure that your deposit only covers damage to the chartered yacht (this should be stated in the charter contract!) and not liability damage . The liability insurance of the chartered yacht is primarily liable for this and, if applicable, the skipper’s liability insurance is also liable. You should note this when concluding the contract and clarify it in writing if necessary:

- that the deposit paid will only be retained for material damage caused to the vessel by you or your crew and that any damage must be evidenced by repair receipts ,

- that there is usually no excess for liability claims and therefore the deposit is not available for liability claims either.

Check whether this is clearly stated in your charter contract. If there are any doubts, make a clarifying supplementary agreement on the above points. This will prevent any legal disputes at a later date. This is important for you. This is because it happens time and again that deposits are withheld at will. And that is then a purely contractual problem

Many charter companies offer their own “charter deposit insurance”. However, these are often not genuine insurance policies , but a self-calculation. There are no reliable conditions and the exclusions – e.g. grounding, damage to the rudder, the dinghy, scratching and scraping damage or the outboard motor – often contradict realistic insurance cover .

Difference between liability and fidelity insurance:

A charter deposit claim is usually damage to the chartered ship that was culpably caused by the skipper or crew and is usually less than the amount of the deductible of the hull insurance.

This damage is covered by the security deposit insurance! If the amount of damage exceeds the Deductible, paid by the owner’s comprehensive insurance.

The yacht owner’s liability insurance covers property damage and personal injury that you culpably cause to others. But what is actually covered and what is not is set out in the owner’s liability conditions, which you do not know. No liability insurance that we know of covers damage to the chartered ship. Hull insurers fall back on the skipper for grossly negligent damage to the ship.

The skipper’s liability insurance covers the (unknown) gaps that the liability insurance does not cover. of the charter yacht, e.g:

- Damage to the yacht due to gross negligence (protects you from liability towards the comprehensive insurer).

- Personal injury to crew members

- Damage to other vessels, insofar as this damage is not covered by the liability of the charter yacht, e.g. because the premium was not paid on time or other exclusions of the charter company’s liability insurance exclude benefits (which you are not aware of), such as personal injury to crew members or similar.

The advantages of YACHT-POOL charter deposit insurance at a glance

- YACHT-POOL's charter deposit insurance is not only valid for a specific charter but for a whole year without limitation!

- 12 months of deposit protection! - Pay for an insurance premium and be insured premium-free for 12 months!

- With YACHT-POOL charter deposit insurance, you can charter anywhere, as often as you like, and with any ship you like!

- Deductible only 5% of the deposit or the lower damage, at least €50

- Protection for skipper and crew

- Valid worldwide!

- Charter deposit insurance of up to 10,000 euros. (and more on request)

- The insurance policies can be customized!

Download PDF application (for printing) for charter insurance

Further insurances for charter skippers:.

Skipper liability

The skipper is liable for damages that he has culpably caused to others with his present and future assets – without limitation – this is your risk! YACHT-POOL includes gross negligence and defense against unjustified third-party claims

Skipper accident insurance

I have accident insurance” you might think. We have developed the special skipper accident insurance for the following reason: Various accident insurers exclude accidents from “risk-prone” sports (increasing trend)

Charter consequential loss insurance

There is a risk that you will cause damage to the charter vessel and therefore the vessel will no longer be operational in time for the subsequent charter and because you are legally or on the basis of the charter contract responsible for the damage.

Charter Cancellation Insurance

The yacht for your cruise is booked, the crew is complete and the anticipation is already high – nothing can go wrong now, can it? Unfortunately already! What happens if the skipper has an accident shortly before the cruise and is unable to make the trip? If a family member is seriously

- + 49 (0) 89 7467 34 90

- Email: [email protected]

- YACHT-POOL Versicherungs-Service GmbH Zimmerauweg 47 A-6370 Reith bei Kitzbühel Austria

Important links

- Legal notice

- Privacy policy

- Cookie settings

You are currently viewing a placeholder content from Google Maps . To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

Top 4 Yacht Charter Insurances for Skippers

Protect yourself and your crew from financial and legal risks during boat rentals, what are the most crucial risks a charter skipper should insure against, which are the typical yacht charter insurance packages, which insurance companies offer what type of packages for bareboat yacht charter, here is a summary of the packages of yacht charter insurance providers:.

| Insurance Package | EIS Insurance | Schomacker | Yacht-Pool | Pantaenius |

|---|---|---|---|---|

| Insures damages to the yacht not covered by the boats hull insurance and under gross negligence, claims among the crew, security deposit due to boat seizure of the yacht and charter loss claims. Premium starts from €65 up to €130 increasing with boat size, type and insured sum. Duration per trip. | Similar coverage like EIS with other limits. Restricted for EU residents + Norway (excl. Italians). Premium starts from €180 yearly. Also weekend rentals and 6 week durations available. | Insured liability risks similar as EIS and Schomaker. Regattas and comercial skippers/crew only on request. Yearly coverage of €5 Millions starts with premiums of €100 (sailboats) and €170 (motorboats). | Only for skippers which are residents in the EU or Switzerland. Starts with pure skippers liability from €21 per charter week for sailboats up to 15 meter length. Isured risks can be individually chosen on application form. Additional risks can be individually added on application form. Options for comercial skippers and regattas online available. | |

| It covers situations where the charter deposit is partially or fully withheld by the owner. 7-8% of deposit amount for single trips and 13-15% for fullyear durations. Regatta risks + 15%. The deductible is 10% of the deposit, at least 100 EUR. | Premium between 15% and 8.6% decreasing with rising deposit amount. Duration: trip-specific. Excluding following citizens: US, CA, RU or UA. | Protection for skipper and crew. Premiums, which cover a whole year start with 15.5% and lower down to 10.8% with rising deposit amounts. Excess of 5%, at least €50 of the deposit or the lower damage. | Deposits up to €20,000 online contractable. Insurance period: trip-specific. Premiums start with 10% of deposit amount and go down to 5% with rising deposit amounts. | |

| Covers up to 100% of travel costs, no deductible. Premium: 3-5% of booked travel costs. Duration: trip-specific or fullyear coverage selectable. | Deductible applicable. Premium: 5-8% of booked travel cost. Duration: trip-specific. For EU citizens except CY, SK and MT. | Deductible of 20% - also possible without deductible on request Premium: 4.7% of booked trip cost. Duration: trip-specific. Worldwide coverage. | Covers upt o 100% of charter, flight, transfer and hotel costs also pro-rata. Premium: 4-6% of booked trip cost when excluding deductible. Duration: trip-specific. | |

| Covers loss of charter fee due to insolvency of charter company. Premium 2.1% of booked charter fee + €15 tax. Maximum insured charter fee is €5,000/week or €15,000 per trip. | Covers loss of charter fee due to insolvency of charter company. Premium 6-9% of booked charter fee. | Not offered. YachtPool offers a similar coverage through a so called "Sicherungschein" via acreditated charter companies. | Not offered. | |

| Covers also comercial skippers and crew members! Insures damages to the yacht not covered by the boats hull insurance and under gross negligence, claims among the crew, security deposit due to boat seizure of the yacht and charter loss claims. Premium from €230 per year increasing with boat size. | On request. | On request. | The liability package for comercial skippers starts from €248 up to €1,240 for the whole year. The premium rises with boat size and insured sum (€3,000,000-10,000,000) |

Book your charter boat insurance online!

| German speaking customers: | German speaking customers: |

FAQ: Frequently asked questions regarding watercraft rental insurances

What is the difference between deposit insurance and skipper liability insurance, what is the typical duration of these insurance policies, what is a secured payment certificate, what is skipper liability insurance, what does deposit insurance cover, how does travel cancellation insurance work, what is charter price contingency insurance, who needs professional skipper liability insurance, what is a third-party liability insurance, how much does skipper liability insurance cost, are there any deductibles for deposit insurance, what factors affect the cost of travel cancellation insurance, can i get coverage for regattas with skipper liability insurance, what happens if my yacht is damaged during the charter, can i get insurance for my crew members, are there any exclusions in these insurance packages, can i cancel my insurance policy if my trip gets canceled, do these insurances cover international charters, is there a difference between personal and professional skipper insurance, how do i file a claim if needed, are there any additional benefits with these insurance packages, how do i choose the right insurance package for my needs.

Sailing Yacht Charter

If you have questions about any boat types or yacht charter destinations don´t hesitate to click on the button below. Fill out the search form and our experts will get back to you immediately. We will prepare you the most competitive quote.

- theglobesailor.com

- Yacht Charter

- How to prepare for your charter

- Life Aboard

- Navigate with confidence

- Covid-19 Info

- The Caribbean

- ALL DESTINATIONS

- Our commitments

Everything you need to know about the Excess Waiver for your Yacht Charter

The most common type of insurance taken out on a yacht charter is the Excess Waiver . What is it? What’s the difference with the boat deposit? Is it compulsory? GlobeSailor gives you all the information you need on this not-always-easy-to-understand insurance…

How does the Excess Waiver work?

The Excess Waiver for a boat rental works in the same way as for a car rental.

The boat’s deductible is the amount below which the boat’s insurer will not pay. The rental company (and the yachtsman) are responsible for covering this amount in the event of a claim. The rental company passes on this amount in the boat’s security deposit. It’s important to understand that the amount of the boat’s deductible is often equal to the amount of the deposit, but not necessarily. A rental company may well ask for a deposit higher than the boat’s insurance deductible…

For example, a customer rents a boat for 3,500 euros, with an insurer’s estimated value of 200,000 euros and a deductible of 4,000 euros. The rental company may ask for a security deposit of 1,000 euros (for minor damage such as the loss of a winch crank, broken crockery, a lost fender, etc.) + 4,000 euros deductible, i.e. a total security deposit of 5,000 euros. In this case, your guarantee will only cover the €4,000 deductible, without the €1,000 for minor damage caused by the crew and not covered by insurance.

It’s important to note that a residual deductible is often applied in the event of a claim. In fact, to raise awareness and encourage responsibility among charterers, even if the insurance reimburses the deductible in the event of damage, an amount of between €350 and €500 remains payable by the charterer.

Many rental companies still prefer to collect the security deposit together with the excess, even if you have taken out the excess waiver. In the event of a claim, the rental company will collect your deposit and your insurance will reimburse you for the excess. The maximum reimbursement amount is generally capped at 8,000 euros.

How much does the Excess Waiver cost?

The price varies depending on the insurance company and broker you choose. For more than 15 years, GlobeSailor has been working with Ouest Assurances , which offers a competitive Excess Waiver service that reimburses quickly and efficiently in the event of a claim.

The Excess Waiver costs between 4% and 8% of the rental amount. The price varies according to the sailing area (Europe or World) and the amount of the boat security deposit. Insurance policy fees are often added by the insurance broker (usually between €20 and €30).

What damages are covered in the event of a claim?

The Excess Waiver covers damage caused to the boat in case of a “sea event” , but in no way allows you to clear yourself of damage resulting from “minor breakage” for which you may be responsible and which remains your responsibility. The notion of ” sea event ” is important and must be clearly understood. A “sea event” is defined as a characterized accident resulting either from external impact of the ship, with a fixed or moving body, or from fire or explosion or natural force of exceptional and unforeseeable intensity, affecting the ship.

Why is the Excess Waiver sometimes mandatory?

Some charter companies require you to take out an Excess Waiver, particularly when chartering a boat with a professional skipper. In this case, the customer must also pay a reduced security deposit (between €500 and €1,000) to make him/her more responsible. It is the skipper and the rental company, not the customer, who bear the vessel’s excess.

We hope these details have helped you understand what a yacht charter Excess Waiver is. We strongly advise you to take out this insurance , which will enable you to sail with peace of mind , because even the most seasoned sailors can always be affected by an event at sea!

For more information, click here to download the insurance contract of our partner Ouest Assurances.

> More articles you might be interested in:

My first yacht charter as a skipper!

Prepare for your sailing course!

GlobeSailor’s Top Tips for Anchoring on your Yacht Charter Holiday

- Charterboat Insurance

- Insurance Glossary

- Marine Links

We Specialize in Charter Insurance for Boats, Marine Vessels and Yachts

Charter boat insurance specialties.

U.S. and World Wide Coverage

Competitive pricing.

Charter Insurance

Yacht charter insurance.

Explanation Deposit Insurance:

Basically all charter bases insure the yachts of their fleets with both third party liability insurance and hull insurance. Simply put, the liability insurance covers damages to other boats, port facilities or strangers. The comprehensive insurance covers damages of the chartered yacht – for hull insurance, there is always a deductible. For this excess that is not covered by the hull insurance, the charterer pays a security deposit.

We always recommend to secure this deposit with a deposit insurance. In some cases, the charter companies offer an own insurance with a “damage waiver”: Buying the non-refundable damage waiver, charterer pay less refundable deposit. But with most charter bases, a deposit insurance with an insurance company is recommended.

Other recommended charter insurances are:

– Skipper’s third party liability insurance

– Charter cancellation insurance – just in case the skipper or crew members become ill

– International travel health insurance, eventually accident insurance

Travel Cancellation Insurance and Travel Health Insurance are recommended as well for guests travelling with Crewed Charters / Luxury Yacht Charters.

Pantaenius has developed comprehensive insurance cover for your charter cruise.

Contácte con Nosotros

Feel free to drop us a line to contact us.

- Legal Advice

- Privacy Policy

Tel: + 49 234 30765190

Service-Hotlines:

+ 49 234 30765190

Powered by Achterspring Yachtcharter:

Yachtcharter connection the best yacht for your vacation aboard.

© 2008 - 2024 Yachtcharter - Connection. All rights reserved

YachtcharterNet.com

Charter Insurance

Charter insurance:.

For bareboat charters, sailors or power boaters should consider insurance for some typical charter risks. All these insurances are of course optional, not obligatory. But we recommend at least an insurance for the security deposit!

Deposit Insurance:

Basically all charter bases insure the yachts of their fleets with both third party liability insurance and hull insurance. Simply put, the liability insurance covers damages to other boats, port facilities or strangers. The comprehensive insurance covers damages of the chartered yacht – for hull insurance, there is always a deductible. For this excess that is not covered by the hull insurance, the charterer pays a security deposit.

We always recommend to secure this deposit with a deposit insurance. In some cases, the charter companies offer an own insurance with a “damage waiver”: Buying the non-refundable damage waiver, charterer pay less refundable deposit. But with most charter bases, a deposit insurance with an insurance company is recommended.

Other recommended charter insurances are:

– Skipper’s third party liability insurance

– Charter cancellation insurance – just in case the skipper or crew members become ill

– International travel health insurance, eventually accident insurance

We will be glad to send you application forms for charter insurance – or just see here charter insurance online

Privacy Overview

How to Buy Charter Boat Insurance

Buying insurance for your charter boat.

Special thanks to Professor Terry Johnson, Marine Recreation and Tourism Specialist from the University of Alaska for this article. Used by permission.

If you operate a charter boat, or other small vessel carrying passengers for hire, you have special legal and liability concerns. There are requirements for operator licensing, safety equipment, drug testing, and so on. Similarly, the kinds of insurance you need are unique, in part because maritime law places extraordinary burdens of responsibility on the master of a vessel.

The vessel owner is responsible for all damages resulting from “negligence,” which has been interpreted very broadly by the courts to include any situation in which a crew-member or passenger gets hurt, other than intentional self-injury.

START YOUR QUOTE

Components of a Vessel Policy

Vessel package policies may have numerous components, but the primary two are: * Hull and Machinery , which covers the vessel and its attached parts, including engines and electronics.

Protection and Indemnity (P&I), which is a broad form of liability coverage.

Hull and machinery vessel policy coverage.

Hull and Machinery coverage is based on agreed value or actual value. Generally, agreed value is preferable because it is established at the time of the policy purchase, usually on the basis of a marine survey. Replacement value is even better, but usually too expensive, or simply unavailable.

Hull policies are either all risk or named hazards. All risk is more inclusive and is better for the vessel owner. With a named hazards policy, the owner can recover only for losses resulting from causes listed in the policy, and that list usually is pretty short. All risk policies cover losses from any cause except those listed, which normally includes only a few causes like acts of war and losses resulting from use in criminal activity.

Hull and Machinery covers not only the entire vessel in the case of collision, fire, or sinking, but also individual components like electronics, deck machinery, and engines. Even an engine with some years’ use may be covered if it suddenly breaks. Normal wear, and damage due to improper or inadequate maintenance, usually are not covered, nor is loss of revenue due to engine breakdown. Coverage of engines and other machinery varies from one company to another.

Protection and Indemnity (P&I) Vessel Policy Coverage

P&I indemnifies (pays) someone for personal injury or property damage caused by your vessel or suffered while a passenger aboard your vessel. It also pays to defend against lawsuits brought against you due to the above, and in many cases the chief function is to pay for an out-of-court settlement to prevent expensive litigation and potentially more costly damage awards.

What a plaintiff stands to gain in a lawsuit is limited by the circumstances and severity of the loss as well as the amount of the vessel owner’s assets.

Courts commonly adjust awards downward to reflect contributory negligence or the degree to which the plaintiffs’ actions contributed to his or her injury or loss.

The purpose of a Hull and Machinery policy is to get the boat back into operation as quickly as possible, and the purpose of P&I is to defend you in litigation, and to protect your assets in the event of a personal injury or damage award.

Some P&I Considerations

Coverage limit. How much P&I coverage do I need? The standard insurance industry answer is—all you can get. Or, more specifically, what is the value of your business and personal property that would be jeopardized in a major claim?

Typically, marine P&I policies provide $300,000 or $500,000. This is per incident, not per person. Ask about excess coverage, often provided by a secondary underwriter, in amounts up to one or two million dollars. (Cruise lines require charter boats that serve their passengers to carry a minimum $1 million P&I policy.) The price of excess insurance is relatively low because it is less likely to be needed. A premium increase of a few hundred dollars can double the coverage.

Pollution. P&I policies usually cover accidental discharge of pollutants, such as fuel or oil, resulting from an accident. If not standard, it should be obtainable as a rider. Pollution cleanup in a remote location can be very expensive, and the vessel owner is liable. Pollution insurance does not cover intentional discharges, nor does it pay fines.

Shore excursion. Your vessel policy covers your passengers only while onboard the vessel. As soon as they set foot ashore they are off your policy unless you have shore excursion coverage. Land management agencies like the U.S. Fish and Wildlife Service, U.S. Forest Service, and Alaska State Parks require it.

Generally shore excursion pertains only to accompanied visits to shore, not drop-offs. Coverage of unaccompanied drop-off passengers is unobtainable through marine underwriters. Operators doing unaccompanied drop-offs should require passengers to sign a services contract that spells out safety issues and contains a hold-harmless clause that absolves the operator of liability.

Divers. Vessel insurance does not cover people in the water, and most vessel underwriters will not cover sport divers, period. Some, in fact, may cancel your coverage if they learn that you are doing dive business. PADI (Professional Association of Diving Instructors) has a dive charter vessel insurance program, but it does not cover divers in the water. The only liability coverage for sport diving is written not for vessel operators, but for dive masters and instructors, although the vessel operator can be named as additional insured. Insurance protection is not available for dive charters unless the divers are under the supervision of a licensed instructor or dive master.

Crew coverage. If you have crew on your boat, they must be specifically covered in your P&I policy, and you will pay for each included individual. Do not buy crew coverage for only one crew-member, if you have more than one, on the assumption that not more than one will get hurt at a time. This can be grounds for policy cancellation.

Passenger medical payments. Good charter boat policies include passenger personal injury coverage, as a “damage control” measure. The limit is relatively low—between $500 and $10,000—but there’s no deductible, and the injured doesn’t have to sue or even file a claim. The vessel owner picks up the doctor or hospital bill, and sends the receipt to the insurer for reimbursement. This coverage protects both the operator and the underwriter against more expensive claims by aggrieved individuals, who have suffered minor injuries but go for a big settlement if they aren’t treated well.

Personal effects. Some but not all P&I policies cover personal effects (crew and passengers), and those that do may have high deductibles ($200-$500). The assumption in the insurance industry seems to be that (1) most people have homeowners policies that cover cameras, binoculars, fishing rods, clothing, etc., and (2) people who are careless enough to drop those items overboard would be too embarrassed to blame the boat operator and claim compensation. These assumptions may or may not be correct, but be sure to know what personal effects coverage is included, and decide if more is warranted. A personal effects policy is another good “damage control” measure to ensure that no one leaves the boat unhappy.

Breach of Warranty Coverage

Breach of warranty coverage is designed to protect the mortgage holder of the boat. It pays off the loan (up to the limit of the policy) even if a loss occurs when the boat is being used at a time, in a location, or for a purpose that is not covered by the policy, a condition that would otherwise void all coverage.

A Word about Assumption of Risk Forms and Liability Waivers

Assumption of risk is a form that the client reads and signs, signifying that the client understands the boat trip is an inherently dangerous activity. Some marine insurers say that the assumption of risk form may, in litigation, contribute to the perception that the operator is cautious and prudent, which may result in a final settlement lower than would otherwise be the case. The liability waiver is a form that attempts to get the client to agree not to sue if an incident occurs. Marine insurers generally agree that the liability waiver form is worthless in most cases, and most don’t require it. One exception would be a hold-harmless contract for unaccompanied shore excursions, as mentioned above.

Passenger Vessel Insurance Checklist

Picking a policy.

- Pick a U.S. domestic company, with at least an “A” rating.

- Get a Hull and Machinery policy that pays on agreed value.

- Determine whether Hull and Machinery coverage is all risk (other than specified exclusions) or named hazards. The former is more inclusive and usually a better deal.

- Check deductibles. The higher the deductible the lower the premium, but in the case of minor damage you may end up paying most or all of the claim.

- Check operating limits, and mandatory lay-up. Five months is typical.

- Try to check the underwriting company’s claims payment history with other operators.

- Remember that policy terms are flexible and negotiable.

Selecting P&I Coverage

- Assess your own exposure, and what assets you have to lose. Unless you have little in business and personal assets, go for the highest P&I available. Inquire about excess coverage. Consider $1 million minimum or more if exposure is greater.

- Get passenger personal medical on top of the full liability coverage.

- If you have inboard engines, be sure to get pollution coverage.

- If passengers will leave the boat during the trip, get shore excursion coverage.

- Don’t forget crew coverage for any employees on the boat.

Why Choose Anchor Marine

- The agents at Anchor Marine have extensive marine insurance experience, and also have experience as charter boat operators. In short we know your business and will do what it takes to get you a policy that not only suits your needs, but one that is cost effective. We are independent agent and will actively shop the market place to make sure you are getting proper coverage at the right price.

Get started today

Charter Boat Insurance

An all risk commercial policy that fully protects your property, passengers and crew..

If you are the owner of a Charter Boat you have come to the right place for your Charter Boat Insurance needs. Charter Lakes has been providing Charter Boat Insurance (uninspected passenger vessels) for 34 years. Our mission is to provide our clients with the broadest coverage available at the most competitive price. We have taken that one step further with the introduction of our new Charter Boat Policy. In our humble opinion, this is the broadest Charter Policy available in the country. Regardless of your budget, we have the flexibility to tailor a policy for you that meets your coverage needs.

Charter Boat Standard Policy Provisions Include:

- Written on an Agreed Value basis

- Disappearing Deductible Clause

- Protection and Indemnity Liability Coverage

- Pollution Liability

- Passenger Medical Payments Coverage

- Personal Property/Fishing Tackle Coverage

- Towing and Emergency Assistance

- Dockside Liability Coverage

- Replacement Vessel Liability

* Please consult one of our agents for complete explanation of coverage *

Optional Coverage Features Include:

- Liability coverage for your employment of Captain(s) and Crew

- Marine General Liability (for land based property like an office or store)

- Charter Legal Liability (for your booking trips on non-owned boats)

- Excess Protection and Indemnity

- Shoreside Liability

- Additional Interests/Loss Payees/Breach of Warranty

Types of Charter Operations We Insure:

- Sport Fishing Charter Boats

- Eco and Nature Tours

- Whale Watching

- Expedition (Multi Day) Charters

Charter Lakes focusses 100% of its energies on marine insurance with a special focus on passenger vessels. We make it easy for you to purchase the broadest coverage available at the most competitive price. Let our experienced Agents go to work for you. Fleet discounts apply.

- Apply for Vendor

- Vendors List

- Delivery & Payments

Yacht Insurance for Charter

From reading this article, charter boat owners will learn about the different types of insurance, policy costs, and which types of insurance are best suited for the yacht charter business. Advice from topRik team lawyers, as always, is based on our own experience with our SimpleSail charter fleet, which is located in our marinas in Croatia and Montenegro.

We would like to warn you right away that this is too broad a topic, like any aspect of insurance legislation, since each individual insurance case has its own nuances. Our legal experts have tried to highlight the main provisions that can guide charter yacht owners when choosing the type of insurance. But before contacting an insurance company to draw up a contract, we still recommend that you first consult with independent lawyers in maritime law.

Overview of All Types of Yacht Insurance on the European Market

Today, the insurance business offers yachtsmen, including charter boat owners, a wide variety of insurance:

- Medical insurance for travel abroad - covers possible expenses associated with the provision of medical care while abroad, usually required by all countries for foreigners arriving on their territory, often has several levels of coverage.

- Third party liability insurance. In the European market, this type of insurance (as applied to shipping) is divided into three main types: shipowner's liability insurance; captain (skipper) liability insurance; personal liability insurance.

- CASCO insurance. This type of insurance covers possible damage to the ship, its equipment and (in some cases) personal belongings on board in the event of damage or loss. It is important that the insurance fully covers all possible maritime risks (from grounding to pirate attacks) according to the principle “what is not expressly excluded is fully included”, which is not yet the norm in Europe.

- Insurance in case of cancellation of a subsequent charter due to damage to the yacht. This type of insurance is now becoming more and more popular. It protects the crew who chartered the vessel from unpleasant consequences in the event that the damage caused by the crew to the chartered vessel is so great that the yacht owner is forced to refuse to rent the boat to the subsequent crew.

- Deposit insurance.

- Insurance against accidents on board.

- Personal accident insurance. This type of insurance typically covers those health-related expenses that are not covered by regular health insurance.

- Insurance against unexpected interruption of charter sailing. This type of insurance policy covers expenses already incurred by crew members in the event that the skipper was unable to take part in the voyage and no replacement was found.

- Insurance against unexpected legal expenses. This is a relatively new and very broad area of insurance, which has special cases for shipowners.

- Life insurance. This type of insurance is usually concluded in favor of close relatives of the insured person in the event of his sudden death.

When concluding the above insurance contracts, you should make sure that the policy covers all insured events on the yacht during sailing.

The owner of a charter yacht, and especially a company, should know what types of insurance contracts a renter can enter into, so let’s briefly look at the main policies.

Charter Insurance. Three Main Policies

Squalls, storms, collisions, groundings - all these phenomena sometimes lead to unpleasant consequences in the form of damage to the chartered yacht. And then the question arises: who will pay for it?

Captain’s Liability Insurance to Third Parties

This form of insurance is the most important for a person chartering a yacht. The specifics of shipping are such that the captain (according to the Merchant Shipping Code) is responsible for almost everything that happens on board. The losses that may be caused in the event of his improper actions (or inaction) may be such that they can easily lead to personal bankruptcy, especially in the event of the loss of the ship, death or serious injury of a crew member. Of course, it is advisable to avoid such a development by insuring your liability.

Often, a charter company, along with a chartered yacht, offers an insurance contract that covers the yacht owner’s liability to third parties. And just as often, captains believe that this agreement fully applies to them as persons who have officially rented a yacht from the yacht owner, and fully protects them in all situations. However, the situation is actually not that simple.

Not in every country such contracts are mandatory (unlike the case with car insurance, for example): in Europe, shipowners' liability insurance is mandatory by law only in Spain, Italy and Croatia.

In a number of countries, such contracts, although mandatory, have an extremely low insurance amount required by law, and there is no uniform procedure even in a united Europe in this regard. If, for example, in Italy such an agreement necessarily covers the amount of damage equal to several million euros, then in Croatia this amount is a little more than one hundred thousand euros, which may be completely insufficient in case of serious damage.

Such agreements may have a lot of clauses (in addition to those already discussed) - for example, limiting the maximum permissible distance from the shore (or even the charter base) within which they operate, etc.

The third party liability insurance contract (as well as the CASCO contract) held by the charter company may contain the previously described clauses regarding the gross negligence of the skipper.

All packaged insurance contracts offered by charter companies are usually written in the language of the charter company's home country, which can make them difficult to read carefully.

In the event of severe damage to the yacht or death of a person, the skipper faces directly with the insurer, who is extremely interested in getting his money back through recourse.

These reasons alone are enough to understand: a captain who wants to go on a charter cruise with friends must independently purchase for himself a separate personal third-party liability insurance that covers as fully as possible all possible unpleasant cases. It is especially important in the case of charter sailing in remote “exotic” regions of the planet.

However, when concluding an agreement on personal liability insurance for a skipper, you must carefully study all its intricacies; first of all, you need to understand which cases are not covered by insurance.

Another difficult case is the situation when a pleasure yacht is rented for commercial purposes (overt or hidden), and the skipper who rented it receives some kind of remuneration for sailing. Typically, insurance companies exclude this possibility from the liability insurance contract for the captain of a charter yacht, providing for skippers for hire a separate contract with different, higher rates.

Deposit Insurance

The deposit insurance protects the crew of a chartered yacht from loss of deposit in the event of damage or loss of the vessel. It should be firmly remembered that the very fact of having such insurance in no way cancels the obligation of the yacht crew to make such a deposit (for example, using a credit card) before setting sail - these are different aspects of the issue.

Often crews of charter yachts do not understand that deposit insurance, firstly, does not cover all possible losses completely (the non-refundable part, that is, the deductible part, is also present here), and secondly, this insurance does not cover all possible causes of loss of the deposit.

Please remember: if during the investigation it is determined that the damage to the yacht was caused intentionally or due to gross negligence of the skipper (or his crew), the deposit insurance coverage will most likely not be paid.

So, is deposit insurance necessary for charter sailing? Compared to third party liability insurance for the skipper, it is not nearly as obligatory. Even in the worst-case scenario, the crew of the yacht will only lose the entire amount deposited, and it is by no means exorbitant. Therefore, this type of insurance pays for itself only in cases of very serious damage to the boat.

But insurance against loss of deposit makes a lot of sense if personal capabilities allow you to charter a yacht several times a year. In this case, on the one hand, the yachtsman may suffer quite significant monetary losses for the year; on the other hand, a number of insurance companies specializing in the yachting sector can offer more favorable annual (rather than one-time) insurance contracts.

Insurance for Unexpected Termination of Charter Sailing

This type of insurance is gaining popularity in Europe and the USA - they even insure their vacations in case of an unexpected end. It cannot be said that this type of insurance is in too great demand in everyday life.

Charter sailing is another matter. A company of six to eight people (sometimes more) gathers on board the yacht, and the success of the trip depends on the group as a whole, but especially on the captain himself. But what if he is suddenly forced to interrupt the voyage at the very beginning or cannot even fly out of the country for one reason or another? And who will reimburse the remaining members of the failed crew for their expenses?

Therefore, companies that have been working in the yacht insurance market for a long time turned to specialists with a request to calculate the likelihood of risks and the final cost of this type of service. The result is a product (now offered by many European insurance companies) that allows yachtsmen to not have to worry about losing money if a sailing trip is interrupted or canceled because the skipper is unable to participate.

As a rule, the cost of coverage includes the costs incurred by participants for round-trip air tickets, as well as the cost of chartering a yacht (in whole or in part). Typically, leading European insurance companies issue such insurance for relatively little money - from 4.5 to 5% of the cost of one-way air tickets, so such insurance seems quite profitable in the case of expensive non-refundable air tickets.

Owner’s Insurance. What to Look For

Insurance issues for owners of their own yachts are much more pressing than for yachtsmen renting a yacht from them. If the latter are responsible for the yacht for only one or two (rarely more) weeks a year, then the owner is obliged to worry about his vessel throughout its entire service life. And here too there are problems.

The shipowner has two main types of insurance: the already mentioned CASCO and third party liability insurance. Let's take a closer look at them.

CASCO Insurance

Insurance in case of damage or loss of a beloved yacht is, without exaggeration, a headache for any shipowner. On the one hand, he wants annual insurance payments to be minimal. On the other hand, it is desirable to have confidence that in the event of damage or loss of the vessel, the insurance amount paid will cover all possible losses and expenses as fully as possible. Therefore, you should take into account everything, even the smallest clauses and footnotes in the text of the insurance contract.

Sailing area. Very often, the insurance contract may stipulate the water area where the insured yacht should be located. As a rule, a short trip beyond its limits poses no threat to the owner of the ship, but if the contract clearly defines the water area of, say, the Mediterranean Sea, and the ship was damaged while ferrying it to the Caribbean, then you can hardly count on compensation for damage .

On-board equipment. It is important that the insurance contract contains the entire list of included onboard equipment necessary for full use of the vessel. But insurers almost never include removable and portable electronics (for example, a laptop) in this list, even if they are regularly used for navigation purposes.

The loss of the vessel. In the event of the loss of a yacht (especially in areas of shipping routes), the shipowner may face additional costs that may exceed the amount of the insurance payment. Such expenses, for example, may include fines for diesel fuel leaking from the tanks of a sunken yacht.

Gross negligence. Insurance companies behave much more strictly with regard to shipowners than with regard to amateur skippers: cases of damage or loss of a yacht due to gross negligence (of the owner himself or his hired captain) are almost never recognized as insurance. Exceptions to this rule are extremely rare and are not widely advertised.

Replacing old with new. Very often, disputes arise between shipowners and insurers about what to do if the cost of equipment or sailing parts supplied to replace failed units exceeds the cost of the old ones. For example, a new mast may turn out to be significantly more expensive than the old one.

Winter storage or repair. Statistics show the following: approximately half of all cases of serious damage or loss of yachts occur while the vessel is out of the water. It is necessary to make sure that the insurance contract takes this circumstance into account. Owners of trailer yachts should take care to clarify the areas covered by transport risk coverage.

Sailing wardrobe. Sail insurance is another concern for the shipowner. Their price is high and wear and tear is difficult to predict, so many insurance companies try to avoid covering them or impose very high deductibles. And damage to sails in strong winds is almost never an insured event - usually with winds of seven or eight force.

Discounts for trouble-free periods. As a rule, insurance companies provide very serious discounts for a long accident-free period - sometimes they can reach 30-40%. The other side of the coin is a noticeable increase in insurance premiums the year after the accident. Some companies, however, avoid this after the very first accident, if the client has been insured with them for several years.

Insurance cover. For a long time in Europe, there were separate clauses in insurance contracts regarding insurance against certain known marine risks. And only relatively recently, contracts were introduced into the practice of yacht insurance that cover damage from any marine risks, with the exception of only those that are specified separately.

Franchise. The non-covered part of the damage is the norm in CASCO agreements; only in the event of a complete loss of the vessel it may not exist. The owner, as a rule, has two options - a small deductible in combination with increased insurance premiums or a relatively large non-covered portion of the damage while keeping premiums low; the difference in their amount can be twofold.

Yacht Owner Third Party Liability Insurance

This type of insurance for shipowners seems no less important than CASCO. The damage that the owner of the vessel is capable of causing to the property, life or health of third parties, even with rare use of his yacht, can be very great.

Moreover, it is absolutely disproportionate to the average insurance premium charged by insurers to shipowners: usually its value in Europe ranges from 20 to 500 euros per year. Therefore, saving on this type of insurance seems completely unjustified. Although, as already mentioned, in European waters with the exception of Spain, Italy and Croatia, it is not required.

In general, the conditions for insurance of the shipowner's liability to third parties do not have any special pitfalls, but you should pay attention to two details.

A very important circumstance in a contract of this type of insurance is the presence in it of a clause on waiver of claims. The presence of such a clause in the insurance contract will mean that in the event of an accident (for example, a collision with another ship), in which the other party will be to blame, but does not have an insurance policy and/or funds to cover other people’s losses, the person insured under this contract (yacht owner) is guaranteed to receive compensation for damage already caused to him from his insurance company. Not every insurance company operating in the European yacht market today provides policyholders with such conditions.

It is also important to understand that the determining moment for the occurrence of an insured event under this type of insurance is the “state of guilt” of the insured person (ship owner). This means that when the shipowner is not at fault in the incident: say, if a yacht belonging to him caused damage to third parties under the influence of force majeure (for example, it was torn off properly moored by a storm), then the insured event should not occur. When concluding an insurance contract, you should pay attention to whether this circumstance is mentioned in the contract.

topRik experts once again remind you that the types of insurance contracts discussed in the charter business, the options and cases mentioned do not cover all the nuances of possible incidents at sea and on land. We advise you to enlist the services of an experienced lawyer in the field of maritime law, as well as a reputable insurance company if you want to truly protect your vessel and those on board.

- Glossary of Nautical Terms

- Law & Rules

- Profile details

- Comparison list

- Gift certificates

- Terms of Use

- Privacy Policy

- Refund Policy

- Tallinn, Valukoja 8/2 (Regus Offices)

- +37253060890

- Mon-Sun 10.00 - 18.00

- [email protected]

- View on map

- Leave feedback

Are you making the most out of your charter?

Jun 18, 2018

As a charter yacht operator, for either a fleet or your own yacht, you’ll know all too well about the chills running down your spine when you hand over the keys to your boat. There is no amount of security deposit or promises that the charter party can make in order to put your mind at ease.

The saving grace is that there are some very comprehensive and understanding insurance policies available to protect you for any damage that your charterer may inflict on your vessel. For that reason we have taken the time to lay out some important factors and hopefully give you a better understanding of the questions that you should ask yourself.

The first valuable element to consider is the application of an excess, or rather deductible as some insurers may refer to it as. A deductible is the own contribution towards any claim that a policyholder bares, and is designed to deteriorate many small claims being made under a policy. For that reason, you’ve got to define your damage deposit careful; make it too high and you deter anyone chartering your vessel over your competitor’s, make it too low and you won’t be covering your costs when an incident does happen.

So why shouldn’t your damage deposit just cover the deductible under a claim you ask? Well we can answer! You should also weigh up what other costs you’ll have, such as factoring the increase of your insurance premium by up to 40%, the cost of having a surveyor thoroughly check over your vessel once the repairs have been completed, and any out of pocket expenses that you may have such as travelling to visit the vessel and your time in handling the formalities.