Yacht Insurance: Know The Pitfalls!

Yacht insurance policies are different for every yacht owner. There is no “one size fits all” solution like with home or car insurance. So buying yacht insurance is quite a bit more daunting to research for coverage and price. While we all hope that insurance is something that we will never need to use, we expect the policy we choose to either fix the yacht or to be fairly compensated when needed.

However, from our own experience and according to a recent BoatUS report, you may not be entitled to a payout with some common types of claims. In this article we will discuss the most common things to look out for when choosing your insurance.

Before the closing of your yacht purchase, your lender will require you to have insurance on your vessel. If you are buying a pre-owned yacht, the lender will generally require a marine survey to use to establish base coverage from the value and replacement value reported on the survey. As a very general rule, the annual premium for private yacht use coverage is 1.5% – 2% of the declared hull value. So, a $100,000 yacht will cost $1,500 to $2,000 per year to cover for Florida-Bahamas “private” use. However, this varies from region to region. Yachts in charter will typically be covered under a “fleet” policy with preferential rates that differ for each charter management company.

Insurance for yachts has been getting harder to obtain because there are many more claims than before. And it’s not just because of hurricanes. Actually, some of the most common types of claims are lightning strikes (Florida and Bahamas) and “sinkings at the dock”. Because of all this, underwriters want to “personalize” the process much more than before and scrutinize every possible negative aspect of the application process.

Tips for Your Yacht Insurance Application Process

- Your Sailing Resume. Expound on your experience in “comparable boats”. If you only have experience with 15ft Boston Whalers and you want to buy a 60ft sailing yacht to cruise to Bora Bora, then securing affordable yacht insurance…or at all…will be difficult. Get some experience on a sailing boat similar to what you plan to purchase. Take some lessons, sail with friends’ boats, and and book bareboat charter being sure to log your hours. The very best way to provide this information is to keep a sailing resume up to date so that when yacht insurance renewal time rolls around, you can make a quick update with the latest new nautical miles or boat experience and hand it over to your broker to arm him or her with the information that enables them to go to bat for you.

- Detailed Description of Current State of Your Vessel. Having this information ready to hand over to your yacht insurance broker is an often-overlooked source of information that improves the accuracy of your coverage and if well-maintained with safety in mind, reduces rates. Much like your sailing resume, create a document or collection of documents and images that describes your boat in detail, calling out all safety features and any renovations or upgrades with dates. Include recent images as proof of these features. Remember, that yacht insurance buying is a very personal experience and the underwriter is looking for ways to assure risk of loss is the lowest possible. The lower the risk, the lower your rates.

- Declaring Your Navigation Area. Carefully declare your navigation area. The best thing to tell the insurance company is that the “navigation area” will be a relatively small area like Florida-Bahamas. (After all, you will, if you are smart, get sailing lessons to operate your new boat in relatively secure waters closer to home). Mention your experience in coastal waters or bareboat charters that have been further afield in more challenging sailing conditions than the navigation area you are declaring. Unfortunately your experience on inland lakes does not count for much. Underwriters don’t count experience in inland lakes unless that is where you will keep your boat.

- Mention Only Current Sailing Plans. Insurance rates vary depending on use and navigation area. If you plan on crossing the Atlantic in the distant future (outside of the policy period you are researching) or if you are considering but not yet committed to living on-board, don’t tell your insurance company now. You want your rates to reflect your current plans, not something you might do. Wait until your plans are 100% confirmed. You will likely owe an additional upcharge to cover the increased navigation area coverage. To save money, delete the old navigation area coverage and replace it with a new coverage area.

- Changing Your Navigation Area/Sailing Plans. When the you are ready to move outside the initial navigation area, note, that changing your navigational area during your policy period is not as affordable as it once was. It is best to plan ahead when you are renewing as that gives you the most flexibility in choosing the yacht insurance company that offers the best rates and coverage in that navigation area. If you lock in to a company that does not support South Pacific sailing with affordable rates, or at all, you will cause yourself much grief. If you have tentative plans to go outside your navigation area in the upcoming year, ask your broker during your insurance selection process about these additional areas without declaring you are going there. Do not put this on any application, but rather have an informal conversation. Even better, talk with your fellow cruisers and yacht owners! Knowing about whether your insurance company covers a contemplated use or area can give you an indication of upcharge costs and potential for coverage of that area.

- Seven Seas Cruising Association yacht insurance recommendations for cruisers

- Our yacht insurance recommendations .

- Relocate During Hurricane Season. Most boat insurance companies offer discounts for moving the yacht outside of the “hurricane belt” during the official hurricane season (June 1 to November 1), so make your hurricane plans for your boat early. You could save quite a bit of money. Just be sure you execute your plans and actually move the boat.

- Try to Work with Insurance Companies You Know. If you already have homeowner’s or auto coverage with State Farm, Allstate, Progressive, or another major insurer, explore the possibility of adding the boat to the policy. You may be pleasantly surprised, but these policies are usually only valid in the U.S. and Bahamas.

- Covering Personal Belongings. Cover your personal belongings with a separate policy, not under your yacht insurance. This is another good opportunity to reach out to your existing home/auto insurer to see what type of renter’s insurance they offer to cover your personal items aboard your vessel.

- Your Address Matters. Underwriters consider an address from a non-coastal state a red flag and considered you an “absentee-owner”, even if you are living on the boat and are really NOT an absentee owner. The address on the application is what counts. So, if you are from land-locked Iowa, do not list that address. Get a mailing address in Florida or another coastal state. Most cruisers get mailing addresses from a mail service where they get their mail sorted and forwarded to their next destination.

- Early Bird Gets the Policy at the Best Rates. Apply for insurance at least two weeks before you need it bound. Do not wait until the last minute. What used to take 45 minutes, now takes several days because underwriters are so, so very cautious. Note that this does NOT include your research time which probably takes at least a month so plan ahead so you have plenty of time to get quotes from several insurance brokers.

- Research, research, research. Get quotes from several yacht insurance brokers including at least one that specializes in your type of vessel and/or navigation area. If you already have a quote from an insurance company, let the broker know so time will not be wasted getting you a duplicate quote

A Few Insurance Terms To Know

Actual Cash Value: In the event of a total loss, the market value, determined by age and condition of the boat at the time of the loss. Boating industry reference materials (NADA Book, BUC Used Boat Guide, ABOS Marine black Book) are often used to determine market value.

Agreed Value: Determined and agreed upon by both owner and insurance underwriter at the time the policy is purchased.

Bind: To start coverage by accepting the quotation offered and meeting the special conditions and agreeing on a date to start coverage.

Binder: Immediate, temporary coverage or proof of insurance until a policy can be issued. Usually good for a 30 day term.

Constructive Total Loss: C ost of a boat’s recovery and repair exceed the insured value.

Cruising Area: The geographic area or waterway where the boat is used as defined on the policy. If the boat is taken outside this cruising area, a cruising area extension is required to continue coverage.

Cruising Area Extension: Required when boat is taken outside the cruising area defined on the policy. Prior notification and approval is required and a fee will apply based on the length of the extension.

Damage Avoidance: Loss prevention, preparation that prevents or minimizes a loss.

Deductible: The portion of a claim to be paid out of pocket. The higher the deductible, the lower your insurance premium will be.

Depreciation: measured decrease in value of the boat, parts and equipment due to age and condition.

Hull ID: Series of letters and numbers uniquely identifying an individual boat.

Loss Payee: The person and or institution paid in a claim settlement, appearing on the boat’s title.

Named Insured: The person or person(s) whose name appears on the insurance policy.

Named Storm: Tropical storm or hurricane as designated by the National Oceanic & Atmospheric Administration (NOAA).

P & I (Protection & Indemnity): Coverage for third-party property damage, bodily injury, or death caused by you or your boat for which you’re found legally liable.

Partial Loss: Any claim incurred that has not resulted in the total loss of the boat.

Salvage: Successful rescue of insured boat from a perilous or dangerous situation.

Wreck Removal: Remove and dispose of the remains of an insured boat when legally required.

MORE ARTICLES ON MARINE INSURANCE

- Latent Defects: A Little Understood Term Results in Boat Owners Not Taking Advantage of Insurance Coverage

- The Seven Seas Cruising Association has a lot of information on insurance, so be sure to check in with them.

Yacht Insurance Shopping Considerations

Most yacht insurance policies are for an “agreed-upon” value. That is, if there is a total loss, then you are paid the “agreed-upon value” with no deductions. Beware of the tricky “actual cash value” policies wherein the underwriter can deduct substantially for depreciation and other reasons. See our interview with yacht insurance company, Hanham Insurance Agency , in which Hugo Hanham-Gross explains ACV policies’ risks in more detail.

- Always buy an “All Risk” policy (vs. a “Named Peril” policy). Some policies exclude coverage in areas like the Bahamas, Florida, and Caribbean and will require you to take the yacht out of the hurricane belt during hurricane season for named and numbered storms and it can be very restrictive. However, companies like our recommended marine insurance companies will cover your yacht with relatively low deductibles.

- Beware of “exclusions” and “clauses” that allow the insurer to disallow payment.

- You will need “Consequential Damage” coverage that will cover losses that often start with a failed part. Unfortunately, many “sinkings” occur at the dock when some small part below the waterline fails like hoses, stuffing boxes, and sea strainers due to corrosion or wear and tear. This is considered a “lack of maintenance” issue, so you won’t be paid for the hose or sea strainer and some policies won’t cover the sunken yacht either as they exclude any “consequential” damage as a result of wear, tear, and corrosion.

- Some policies only pay the cost of cleaning up a fuel spill if it occurs due to a “covered loss.” So if your sunken boat wasn’t covered because of a failed part, the resulting fuel spill won’t be either. Sometimes fuel spill coverage is subtracted from other liability payments. A better policy separates out fuel-spill liability and provides coverage up to the maximum amount you can be held liable for under federal law, which currently is $854,000.

- In every hurricane, yachts drag and get blown off their moorings and need to be salvaged. Retrieving the yacht may require cranes, travel lifts, and other heavy equipment costing hundreds of dollars per foot of boat length. However, some policies subtract the money paid to salvage the boat from what you get paid to fix the boat, while others only offer salvage coverage up to 25% or 30% of the insured value. Look for separate salvage coverage up to the insured value of the boat in addition to any payments to fix the boat or replace equipment.

- If your boat gets destroyed completely by fire or some other reason, you end up with a “wreck.” Most insured yacht owners assume their policy will cover the cost of cleaning up what’s left, but some policies will give you a check for the insured value and only a specified percentage for wreck removal – 3% to 10% – nowhere near enough for the clean-up job. Better policies pay up to the liability limit, usually $100,000 or more.

There are other things to look out for like dinghy coverage, medical coverage, trip interruption, liability, and more. But generally, the above mentioned are the “tricky” parts and you should make sure that you understand each clause.

Estelle Cockcroft

Join our community.

Get the latest on catamaran news, sailing events, buying and selling tips, community happenings, webinars & seminars, and much more!

2 thoughts on “Yacht Insurance: Know The Pitfalls!”

Outstanding suggestions. I have heard: It is best to hire a Insurance Agent to “shop” multiple Companies Most Insurance Companies want full payment at the time of issuance.

Be well & Thank You.

Thank you! Yes, it is advisable to use an agent like Hugo Hanhamm Gross. See his details in our favorite links / partners. Some insurance companies will allow partial payments and we have had a good experience with Hugo. He almost always can pull something off for us. However it depends on where you will cruise, your experience as a sailor among other things.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

Top 10 Reasons to Sell (and Sail) Your Catamaran in Annapolis, MD

We have a new home in Annapolis! The office is located in Annapolis, Maryland

Top 10 Reasons to Sell (and Sail) Your Catamaran in Texas

Our Texas Office is located in the Watergate Marina Center in Clear Lake Shores,

Annapolis Boat Show 2024

Meet with our team! Want to learn more about the Bali and Catana

Exploring the Catana OC 50 Catamaran: A Comprehensive Overview

The Catana OC 50 Catamaran, the latest addition to the Catana Ocean Class series,

For more than 30 years, we have been a part of the catamaran community and created Catamaran Guru™ to encourage and educate all the aspiring sailing out there. We understand the dream of traveling the world by catamaran and created a one-stop-shop to make that dream a reality for you.

- Stephen & Estelle

- Testimonials

Get Started

- Yacht Sales

- Used Yachts

- Charter Management

- Boat as Business Programs

- Seminars & Events

- Insurance Quote

- Charter Quote

- Catamaran Links

Catamaran Insurance: All Oceans - All Catamarans - Yachts and Boats

Remember at Catamaran Insurance our Only Business is Yacht Insurance.

CATAMARAN INSURANCE by W.R. Hodgens Marine Insurance, Inc. 1425 South Andrews Ave Suite 250 Fort Lauderdale, FL 33316 Ph: 954-523-6867 Fax: 954-523-6488 Toll Free USA: 800-990-WAVE (9283) [email protected]

About Chubb: About Chubb

About Chubb: About Chubb in the U.S.

About Chubb: Careers

About Chubb: Citizenship

About Chubb: Investors

About Chubb: News

Claims: Claims

Claims: Claims Difference

Claims: Claims Resources

Claims: Report a Claim

Login / Pay My Bill: Login for Business

Login / Pay My Bill: Login for Individuals

Login / Pay My Bill: QuickPay for Businesses

Login / Pay My Bill: QuickPay for Individuals

Login / Pay My Bill: APT for Travel Advisors

Contact Us: Contact Us

Contact Us: Global Offices

- File a claim

- Get a quote

Yacht Insurance

Protect your superior watercraft with superior protection from Chubb.

Chubb has been a leading provider of yacht insurance for over 100 years, offering some of the most comprehensive policies available for private, pleasure watercrafts. Being on the water is an experience of peace, calm, and new adventures on the horizon. It’s an experience you want to protect. Our Masterpiece® Yacht insurance policy offers superior coverage for pleasure yachts 36 feet or greater in length. And for captained vessels 70 feet or greater in length and valued at $3 million or more, our Masterpiece Yacht Preference policy has the specialty coverages you and your crew need.

Masterpiece® Yacht Policy Highlights

Agreed Value Coverage

We pay the entire agreed amount, with no deductible, for a total loss. With our Masterpiece Yacht Select policy, eligible vessels can receive Replacement Cost coverage up to 120%.

Liability Protection

Limits of coverage to suit your personal needs, including: legal defense costs, liability as required by the Oil Pollution Act of 1990, wreck removal, and Jones Act coverage for paid crew.

Replacement Cost Loss Settlement

Repair or replacement of covered property is paid for without deduction for depreciation for most partial losses.

Uninsured/Underinsured Boater Coverage

Pays for bodily injury to persons aboard the insured watercraft who are injured by an uninsured owner or operator of another vessel.

Medical Payments

Reasonable medical and related expenses are included for all those onboard, boarding or leaving the covered vessel. These benefits are provided on a per person basis, rather than per occurrence. Optional and customized limits are available.

Search & Rescue

Up to $10,000 for the expenses incurred by an insured in relation to a governmental unit such as the United States Coast Guard (USCG) who provide emergency aid and assistance are included for no additional charge. With our Masterpiece Yacht Select option, coverage is available up to $25,000.

Longshore and Harbor Workers’ Compensation Act (LHWCA)

When Liability coverage is purchased, coverage is automatically provided for those employed aboard the vessel who are within the jurisdiction of the LHWCA.

Personal Property & Fishing Equipment Coverage

Protection is automatically included for the clothing, personal effects and fishing gear of the boat owner and their guests. Optional higher limits are available.

Coverage for Marinas as Additional Insured

Marinas, yacht clubs and similar facilities where clients keep their vessels are included as Additional Insureds.

Trailer Coverage

We automatically include coverage up to $5,000 for your trailer used with your insured vessel. Higher limits are available.

Emergency Towing & Assistance

Our policy includes this coverage with optional higher limits available.

Boat Show & Demonstration Coverage

We automatically provide this coverage, at no additional charge.

Precautionary Measures

We will pay up to the policy limit the reasonable costs incurred to haul, fuel or dock the insured watercraft endangered by a covered peril.

Bottom Inspection

We will cover the reasonable costs to inspect the bottom of an insured vessel after grounding, stranding, or striking a submerged object. There is no deductible for this coverage.

Oil Pollution Act of 1990 (OPA) Coverage

If Liability coverage is purchased, our policy provides coverage in addition to the Liability limit, up to the required OPA statutory limits, regardless of the Liability limit chosen. Additionally, if the OPA statutory limit is increased in the future, our policy will automatically increase the applicable OPA limit to match the new higher statutory limits.

Temporary Substitute Watercraft

Up to $5,000 to charter a temporary substitute watercraft if the insured vessel is out of commission due to a covered loss and cannot be repaired within 72 hours. With our Masterpiece Yacht Select policy offering, the limit of Temporary Substitute Watercraft is increased to $10,000.

Marine Environmental Damage Coverage

This feature provides protection up to $10,000 for fines and penalties as a result of marine environmental damage, as defined by the policy terms. Coverage is provided in addition to the insured's applicable Liability and OPA limits. With our Masterpiece Yacht Select policy offering, the limit of Marine Environmental Damage Coverage is increased to $25,000.

57% of boating accidents happen on calm days with waves less than 6 inches.

Chubb offers some of the most comprehensive protection and services available rain or shine.

*Source: 2016 Recreational Boating Statistics, United States Coast Guard

Masterpiece Yacht Preference

Masterpiece Yacht Preference fulfills the specialty insurance needs of luxury yacht owners with captained vessels 70 feet in length and greater, valued at $3 million or more.

No depreciation applies on the following items

Machinery inside the hull, Personal Property, dingy/tender, and Personal Watercraft.

Emergency Towing Service

We include coverage up to the amount of Property Damage with no deductible.

The medical payments limit offered is on a per occurrence basis, and we will pay costs incurred up to three years from the date of occurrence.

Marina as Additional Insured

The marina, yacht club, or similar facility where the insured yacht is docked, moored, or stored is included as an Additional Insured.

Captain and Crew Coverage

Liability coverage is extended to the captain and crew members serving aboard the insured yacht.

Defense Costs

Defense costs are included in addition to the limit of liability and includes up to $50,000 loss of earnings.

Mooring or Slip Rental Agreement Waiver

When waiver of subrogation is required through a written contract by a yacht club, marina, or similar facility used for the purpose of storage or slip rental, our Masterpiece Yacht Preference policy will permit an insured to waive their rights of subrogation.

Masterpiece® Recreational Marine Insurance Brochure

Your client’s guide to watercraft protection. Make sure they’re protected, with the right coverage, so they can relax on and off the water.

Related Coverage

We provide exceptional boat insurance with tailored protection.

We help you stay ahead — and informed with these helpful tips and tricks

This information is descriptive only. All products may not be available in all jurisdictions. Coverage is subject to the language of the policies as issued.

Find an Agent

Speak to an independent agent about your insurance needs.

- Agent Directory

- Company Directory

Find an Independent Agent

- Get Matched with an Agent

- Agent Directory by State

Find an Insurance Company

- Get Matched with a Company

- Company Directory by State

What type of insurance do you need?

- Business Insurance

- Home, Auto & Personal Insurance

- Life & Annuities

By Coverage Type

- Commercial Auto Insurance

- Professional Liability Insurance

- Small Business Insurance

- Business Umbrella Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Business Owners Policy

- Builders Risk Insurance

- Cyber Liability Insurance

- Surety Business Bonds

- Inland Marine Insurance

- Employers Liability Insurance

- Employment Practices Liability Insurance

- Environmental Liability Insurance

- Errors and Omissions Insurance

- Insurance Coverage & Advice by State

- See more ...

By Business Type

- Retail Store

- Agriculture & Forestry

- Construction

- Manufacturing

- Wholesale Trade

- Retail Trade

- Transportation & Warehousing

- Information Industry

- Finance & Insurance

- Real Estate

- Scientific & Technical Services

Auto & Vehicle Insurance

- Car Insurance

- Motorcycle Insurance

- Boat Insurance

- RV / Motorhome Insurance

- ATV Insurance

- Snowmobile Insurance

- Personal Watercraft Insurance

- Collectible Auto Insurance

- Umbrella Insurance

Home & Property Insurance

- Homeowners Insurance

- Condo Insurance

- Farm Insurance

- Landlord Insurance

- Renters Insurance

- Mobile Home Insurance

- Contents Insurance

- Vacant Land Insurance

- Flood Insurance

Other Insurance

- Life Insurance

- Long Term Care Insurance

- Disability Insurance

- Health Insurance

- Special Event Insurance

- Short-term / Sharing Insurance

Insurance Solutions & Resources

- Compare Car Insurance

- Compare Home Insurance

Yacht Insurance

Finding the perfect coverage has never been easier.

Insurance doesn’t have to be boring. That’s why we hired Sara East to be our BA insurance writer. Maggie specializes in making mundane subjects hella-entertaining.

Yachts are a luxurious way to be on the water, but owning a yacht means having the right insurance in the event of damage or being destroyed. Because of their price, repair or replacement is likely to be very expensive making the proper coverage crucial for boat owners.

Before using your yacht, an independent agent can work with you to create a customized yacht insurance policy to your specific watercraft, its value, and how you use it.

Boating Statistics

No one likes to think about the dangers of boating, but accidents can happen and it's best to be prepared in the event that you face unexpected hardship. Whether you hit another boater, have an incident with a passenger, or your boat is damaged while being transported or docked, lots of things can lead to a financial headache for you.

Here are some statistics about boating accidents.

- Cabin motorboats, which include yachts, accounted for 14% of all boating accidents

- Only about 20% of all boaters who drowned were on vessels larger than 21 feet

- Operator inattention was cited as the leading cause of accidents involving cabin motorboats

What Is Yacht Insurance and What Does It Cover?

Yacht insurance is a specialized type of boat insurance for luxury boats. Yachts can be used for personal as well as commercial use, so insurance policies must be created to accommodate each of those needs.

While yachts, like most boats, depreciate over time, they still generally have a much higher than average value. Because of their high values, a standard boat insurance policy may not provide enough coverage for your vessel.

The components of yacht insurance are similar to standard boat insurance coverage.

- Bodily injury and property damage liability: Covers the costs associated with injuries or property damage you cause to another person, as well as legal fees. If the liability limits in your yacht insurance policy are not adequate to protect your assets from a lawsuit, you may want to consider buying an umbrella liability policy , which provides a much higher liability limit.

- Collision coverage: Pays for damage to your boat after a collision with another boat or object.

- Comprehensive coverage: Covers non-collision damage or loss, including theft, fire, vandalism, or damage caused by an object other than another boat.

Additional yacht insurance options to consider

- Uninsured/underinsured boaters insurance: Covers any damage or injuries from an accident with an uninsured or underinsured boater. Since boat insurance is rarely required by law, if you have a significant amount invested in a vessel, this is a good insurance option to discuss with your agent.

- Medical payments coverage: Covers medical expenses and funeral expenses for anyone on that is injured, entering, leaving or while on your boat.

- Equipment and personal effects coverage: Pay to repair or replace damaged or lost items such as gear, fishing equipment, cameras, and other personal belongings.

An independent agent can work with you to determine the appropriate coverage for your needs. Because these agents work with multiple insurance companies, they can help protect all of your interests with a broad range of insurance coverage, all from one agency office.

Is Yacht Insurance Different from Standard Boat Insurance?

Yacht insurance provides similar types of coverage as standard boat insurance . However, yachts have some specific differences from standard boats, and yacht owners generally need certain protection that regular boat insurance does not provide.

For example, a yacht policy tends to restrict hauling on a trailer to only a few hundred miles, while boat insurance tends to provide coverage for trailering over longer distances.

Also, deductibles for yacht policies are very flexible, instead of having set amounts like $250, $500 or $1,000. In addition, yacht policies can include coverage for raising and removing a sunken yacht, while boat policies generally do not include this coverage.

Is Yacht Insurance Required?

Yacht insurance is not typically required by state law. However, sailboats often do have insurance requirements. So, if you have a sailing yacht, insurance may be required by law.

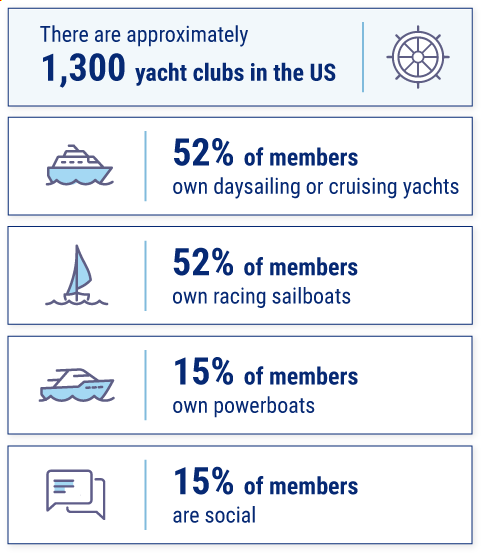

Yacht club membership statistics

You will also need to buy insurance to protect your investment in your vessel if you finance the purchase of your yacht through a lender.

Many marinas require that you have insurance in order to slip your boat at the marina. Check your local marina's guidelines, and be sure to learn about your state’s laws and regulations.

Do I Need Yacht Insurance?

A yacht can range in price from $300,000 to several million dollars. Purchasing one is a big investment and having the ability to insure your investment can ease your mind if there's an accident or your yacht needs repairs or replacement.

Insuring your yacht is also not just about the boat. In the event that an injured party files a liability claim against you, you will want to have enough coverage in place to protect your boat, home, savings, investments, and future income.

Assessing your financial situation will help you to determine how much yacht insurance you need.

Save on Boat Insurance

Our independent agents shop around to find you the best coverage.

How an Independent Insurance Agent Can Help with Yacht Insurance

A local independent agent will talk with you, free of charge, to learn about your yacht and insurance needs. They'll gather multiple quotes for you from several different companies and help you compare options and rates. Your agent can assist you with every aspect of your insurance and will be your point of contact if you need to file a claim.

An independent agent can help to prevent gaps in coverage that leave you exposed to risk. You will know you are getting the right coverage for your needs, and that you are not paying for any unnecessary coverage.

https://www.ussailing.org/wp-content/uploads/2018/01/Demographics2010.pdf

- Boat Reviews

- Press Releases

A Yacht Insurance Primer for First Time Owners

The following article is designed to provide prospective yacht owners with an overview of the yacht insurance process. It should in no way be considered guidance. As detailed below, owners are advised to consult with an experienced marine insurance broker when acquiring or modifying their policie s.

Setting a course for peace of mind

Successful sailing experiences are built on a foundation of preparation and planning. From the boat’s gear and stores to its course and crew, every aspect of the trip must be thought through and squared away.

The same principle applies to yacht insurance, which is, of course, critical to a safe and relaxing journey. Unlike more common coverages, such as auto or home insurance, yacht insurance requires owners (especially first-timers) to prepare and plan for all sorts of eventualities and events.

Prepping for the right policy

Here are some of the issues would-be policyholders should be prepared to address as they seek the right policy for their yacht.

For openers, first-time yacht owners who expect to pilot their own craft must demonstrate a minimum level of boating experience.

“If you don’t have any experience, an insurance carrier will insure you, but you’ll be required to use a [professional] captain every time you go out on your boat,” says Hugo Hanham-Gross, a yacht insurance specialist with the Hanham Insurance Agency in Fort Lauderdale. “That can really limit your cruising options.”

Gaining experience

Fortunately, there are several easy ways to gain enough maritime experience to satisfy insurance carriers, says Hanham-Gross.

“You don't have to take sailing classes,” he says. ”If your friends have boats, get as much experience as you can on their boats. If you are buying a Leopard, this experience doesn't have to be on a catamaran. It can be on a monohull sailboat. It can even be on a motorboat - just get as much experience as you can.”

It’s important to log those hours - when, where, type of boat - in case the insurance carrier asks for confirmation. Hanham-Gross says this record can be as simple as a series of entries on a smartphone, so long as it’s truthful and accurate.

Learn from the best

Newbies can also meet the experience requirement by hiring a training captain and spending a few days on the water with her. When the captain feels the owners are ready to take the helm, she will sign a document certifying their readiness.

Hanham-Gross recommends submitting a sailing resume with a yacht insurance application. This document should provide carriers with background information about the applicant and detail their relevant boating experience and training. As with any resume, padding is a no-no.

“The carrier doesn’t care that you went sailing with your dad for an hour on a Hobie Cat when you were 13,” says Hanham-Gross.

Caribbean cruising?

Insurance carriers will also want to know where the applicant plans to operate their yacht. The answer may impact both the premiums charged and the yacht owners’ ability to wander. A U.S. waters-only policy, for example, would limit an East Coast policyholder’s ability to adventure in the Caribbean or a SoCal owner’s options down Mexico way.

Yacht owners who plan to spend significant time in the Caribbean should expect to jump through a few more insurance hoops. For example, some carriers will not insure yachts for travel in the Caribbean because of the hurricane threat. Those that do write such policies may require (or incentivize) policyholders to stay out of the region during hurricane season, which runs from June through November.

Applications for Caribbean coverage must typically include a hurricane plan . This document should list the places across the region where the yacht owners will seek shelter if a hurricane looms. The more detailed the plan, the better, says Hahham-Gross.

“The carrier wants to know how will you protect the boat, and what is your backup plan,” he says. “With a hurricane coming, you can’t just weigh anchor and sail 500 miles to the one marina on your list. If you give that answer, the carrier won't write the policy because that attitude shows you aren’t taking the hurricane threat seriously.”

What are your cruising plans?

Insurance carriers will, understandably, also want to know how a prospective policyholder plans to use their yacht. If the applicant plans to live aboard their craft, they should disclose that to the carrier. Carriers have different definitions of “living aboard.” That status typically has only an incremental impact on the owner’s premiums. Most policies do not allow the yacht to be rented unless the renters hire a captain.

Finding the right insurance broker

The requirements and complexities of yacht insurance, which vary widely among carriers, can make the application process seem daunting. For that reason, newcomers are well-advised to work with an experienced yacht insurance broker. Such a professional can help owners determine their insurance needs, identify suitable carriers, and advocate for the owner during the application process and beyond. Building a strong connection with a broker is especially valuable for Leopard owners, says Hanham-Gross.

“That relationship is so important with catamarans because people who buy Leopards aren’t looking to sit in the Chesapeake Bay,” he says. “Their dream is to go to the Caribbean or the South Pacific. I probably talked to my Leopard owners five to six times a year because they constantly have to make changes to their policies.

Let there be no surprises

A broker can also help with the weird things that come up for large boat owners. For example, when you go into a marina now with a big boat, like a catamaran, the operator sometimes requires a certificate of insurance that names the marina as an additionally insured party on the policy.”

A broker is like a pilot. His training and unique expertise are invaluable as a new yacht owner navigates the shallows and channels of insurance towards the open waters of full coverage and the endless adventure it makes possible.

Topics: Boat Buying Process , Boating Tips

Leopard Catamarans

Subscribe here.

Log in to Markel

- US Broker Agent

US customer login

Log in to make a payment, view policy documents, download proof of insurance, change your communication and billing preferences, and more.

Log in to access admitted lines for workers compensation, business owners, miscellaneous errors and omissions, accident medical, general liability, commercial property, farm property, and equine mortality.

Markel Online

Log in to access non-admitted lines for contract binding property & casualty, excess, and commercial pollution liability.

MAGIC Personal Lines portal

Log in to access personal lines products including marine, specialty personal property, powersports, bicycle, and event insurance.

Markel Surety

Log in to access Markel's surety products.

- News and press

Boat and yacht insurance

The marine insurance leader

Your boat is more than "just a boat" to you. It represents a lifestyle that deserves to be protected by the best marine insurance on the water. With over 45 years of marine insurance experience, Markel provides a level of expertise that is unsurpassed in the marine industry.

Plus, unlike a typical homeowners insurance policy, we focus on marine insurance and have developed a wide variety of marine insurance coverage for almost any type of boat or watercraft.

What we offer

Our marine insurance offerings include:.

Specialized coverage designed specifically for boats 26 feet or less, such as pontoons, runabouts, fishing boats and more.

For watercrafts greater than 26 feet in length, such as a yacht, sailboat, sport fishing boat, trawler or houseboat.

High performance boat

Coverage for speedboats greater than 26 feet in length and capable of speeds 66 to 120 m.p.h.

Personal watercraft

Insurance for personal watercrafts (PWCs) such as a Jet Ski, Sea-Doo or WaveRunner.

- USED CATAMARANS

- BUYING A LEOPARD

- SELL YOUR BOAT

Yacht Insurance Explained: Costs and Crucial Considerations

Navigating the process of insuring your new boat has become increasingly intricate and costly since the significant hurricane season of 2017, compounded by the impact of Hurricane Ian in 2022, which led to substantial losses for insurers due to yacht damages. Traditionally, an annual premium of approximately 1-2% of the hull value served as a rule of thumb; however, it has progressively edged closer to the 3% threshold. Additionally, limitations on areas of use have become commonplace. It's important to note that if you haven't owned a yacht within 10 feet of the size you are purchasing, you may be obligated to spend additional days onboard your new boat, accompanied by a licensed Captain to assess your proficiency as an operator.

While it is not our intention to deter you, it is essential to address the reality upfront that securing insurance for your cherished possession may prove to be one of the most challenging aspects of your yacht ownership journey. The available options for insurance coverage may vary depending on the location of your ownership, whether it be the US East Coast, Florida, Caribbean, South Pacific, or Mediterranean regions.

As your trusted Moorings/Leopard Yacht Broker, we maintain extensive connections within the insurance industry. Our experience has shown that collaborating with a specialized marine insurance broker can yield advantages in finding the most suitable policy tailored to your unique circumstances, taking into account factors such as your expertise, area of operation, and the time of year.

If you are contemplating a yacht purchase in the future, we encourage you to reach out to us. Initiating the conversation will enable us to connect you with seasoned insurance agents. In the past, insurance matters may have been considered one of the final pieces of the puzzle, but in the present landscape, it is advisable to commence the process early, concurrently with your boat shopping journey.

Leopard Catamarans

Subscribe for blog updates.

Contact Form eList Newsletter Signup Email: [email protected]

More Boats for Sale

New Private Yachts New Charter Yachts Used Charter Yachts

LIKE / FOLLOW