Average Boat Insurance Cost (With 15 Examples)

Getting your boat insured can be quite a complicated process if you’ve never done it before, and getting an accurate average price can be almost impossible without spending entire days researching all the various insurance companies.

When I got my first boat I spent two entire weeks looking through all the insurance possibilities, reading all the clauses in the contracts, and getting quotes from all the possible companies.

When I got my second boat and I had to get it insured I already knew everything that there is to know about boat insurance so I managed to solve everything in just a couple of hours. So to help others that are entirely new to this process I decided to write this guide that will let you know everything that there is to know about insurance, from the average prices, to what influences those prices, to all the things that you have to be careful about.

The average boat insurance cost is around $300 per year ($25 per month), but depending on the type of insurance prices can vary between $150 and $500 per year ($12,5 and $41,5 per month).

Table of Contents

15 Examples of Average Insurance Prices

For those examples I went to multiple insurance companies and requested insurance prices for them for 15 different boats. In this article you will see that there are different types of insurances. For those examples I requested an insurance that will cover basic liabilities, so no extras.

| Bowrider | Tahoe T16 | $208 |

| Bowrider | Bayliner 160 | $215 |

| Bowrider | Bayliner Element E16 | $261 |

| Flat | Mako Pro Skiff 17 | $231 |

| Flat | Mitzi Skiffs 17T | $291 |

| Flat | Xpress XP 18 CCT | $269 |

| Pontoon | Sun Tracker Buggy | $151 |

| Pontoon | Bennington 168 SLV | $165 |

| Pontoon | Tahoe Sport Cruise 14 FT | $148 |

| Jet Boat | Scarab 165G | $292 |

| Jet Boat | Yamaha Boats SX190 | $318 |

| Jet Boat | Yamaha Boats SX195 | $384 |

| Fishing | C-Hawk 16 Tiller | $163 |

| Fishing | Tracker Pro Team 175 TF | $205 |

| Fishing | Carolina Skiff 178JLS | $209 |

So those are the average insurance costs that I got from multiple insurance companies. But it;s very important to keep in mind that I requested the most basic insurance, so if you want to get some extras you might spend some extra $50 or $100.

Another thing to keep in mind is that the insurance price will differ based on a lot of factors, when I requested a price for the examples above I tried to keep things as average as possible. So I assumed I have no prior experience with boats, very minor driving incidents, that the boat will be used at least a couple of days per month, and that I have an average credit score.

Those things are very important because they can influence the prices quite a lot. So let’s take a closer look at those factors and how they influence the insurance cost.

Factors That Influence Boat Insurance Cost

Use of the Boat , depending on how you will use your boat the cost will increase or decrease accordingly. If you will take your boat out for fishing 3 or 4 times a year then the rates will be quite small, but if you will take it out every weekend for watersports then the rites will be higher.

Boating Experience , having a few years of experience with boats will make the rates cheaper, while having no prior experience will increase them.

Motor Vehicle Driving Record , most people don’t expect this to come into play but it does, and it’s really important. If you have a bad driving record it will reflect in the rates that you will have to pay for your boat insurance.

Other Drivers Experience , when you apply for boat insurance you will be asked who will be driving, and adding a person with no boating or driving experience to the list will increase the cost.

Boat Insurance Records , if you had multiple incidents in the past, your rates will go up.

Horsepower , the more horsepower your boat has, the higher the rates will be, but don’t let this discourage you from getting the boat you want, the increase in price is not that significant.

Specs of the Boat , this includes the year it was made, the model, the maker, inboard or outboard motor, etc.

Credit Score , insurance companies have found that a person with a lower credit score is statistically more prone to boating accidents. So a person with a low credit score will have to pay more for their insurance.

Ways to Reduce the Cost of the Insurance

Depending on the company that you choose, there might be some ways to reduce the cost of the insurance. Sometimes a company won’t put those information on their front page, so you might have to speak to somebody and ask them if they are available.

Multi-policy , most insurance companies will give you a discount if you already have some kind of insurance with them. So if you have your car, or your house already insured call those companies and ask them if they insure boats, and if they offer a discount.

First Owner , make sure you mention that you are the first owner, some companies will offer you smaller rates if you are the first owner. Most companies will ask you about the condition of the boat, but saying that the boat is in good condition, and saying that the boat is brand new can sometimes make a difference.

Changing Companies , if you already have an insurance but you are not pleased with it, mentioning this to another company can get you quite a considerable discount, if you want to change the insurer.

Multiple Boats, ensuring multiple boats will most often result in better rates, but make sure that you mention this from the start and don’t insure separately.

Association Member , if you are a member of an association like the United States Coast Guard Auxiliary (USCG) or United States Power Squadron (USPS), most companies will give you a discount.

Pay in Full , if you pay everything from the start, instead of monthly rates you will obtain quite a significant discount.

Safety Course , if you complete any state approved safety course you will obtain better rates from the insurance company. In the first year this won’t necessarily save you any money, but the next year you won’t have to pay for the course again and the discount will still be there. And since you took a safety course you will also be less likely to hit your boat.

Basic Insurance vs Comprehensive Insurance

Another important thing that will drastically influence the price is the type of insurance that you will get.

Basic insurance will usually only cover liabilities and it’s the cheapest option. What this insurance includes can vary slightly from company to company, but in general you can expect them to include:

- Property damage liability: Covers harm done to another person’s boat, dock, water skis or other possessions

- Pollution liability: Covers you in the event of a fuel spill

- Wreckage removal: Covers your legal obligation to remove debris after an incident

Comprehensive insurances will usually come with multiple options and they include the ones mentioned above, as well as medical treatment, damage to your own boat and some other stuff depending on the company. This option is usually more expensive, but in my opinion it’s usually worth it since a lot of basic insurances don’t cover the damage inflicted to your own boat, and of course the medical treatment.

If you only go fishing a few times a year in calm waters, the basic insurance is probably what you need. But if you want to every weekend of the summer on the boat, then a more comprehensive insurance might be better for you.

Final Thoughts

The price of the insurance can vary depending on a lot of factors, but most of those factors won’t change it that much. In most cases a person will have factors that increase and factors that decrease them, for example a person might not have any boating experience so this will add to the insurance coast, but he will have a very good credit score which will reduce the insurance cost.

But as I said in the beginning of the article on average you can expect to pay around $300 for the boat insurance.

John Rivera

My name is John Rivera and I am the creator of BoatingRepublic.com. I’ve been a boat owner for more than 30 years, and a boating instructor for 10 years.

Recent Posts

Easy Johnson Boat Motor Identification (With Examples)

Reading a Johnson identification number can be difficult if you don’t have proper guidance, since there are four different ways the motors have been noted. The Johnson Outboard Motor Company has...

Easy Yamaha Boat Motor Identification (With Pictures)

The way you read the identification on a Yamaha model will greatly depend on the year it was made. Initially Yamaha used letters from A to Z to mark the production year, but after the letters had run...

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Boat Insurance: An In-Depth Guide

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Do you need boat insurance?

What boat insurance will pay for, boat insurance costs and discounts, where to buy boat insurance.

Your prized boat probably didn’t come cheap. Whether you own a bass fishing boat or a yacht, it’s important to find the right boat insurance that will come to the rescue if you have damage or theft. Here’s how to understand boat insurance policies.

Your home insurance policy covers your boat in some cases, but it doesn’t go far. Homeowners policies typically cap boat coverage at $1,000 or 10% of your home’s insured value. And liability coverage — which pays for damage your boat does to others — typically isn’t included under home insurance. So a home insurance policy might help you only if your boat is small, slow and inexpensive.

At a glance: Do I need boat insurance?

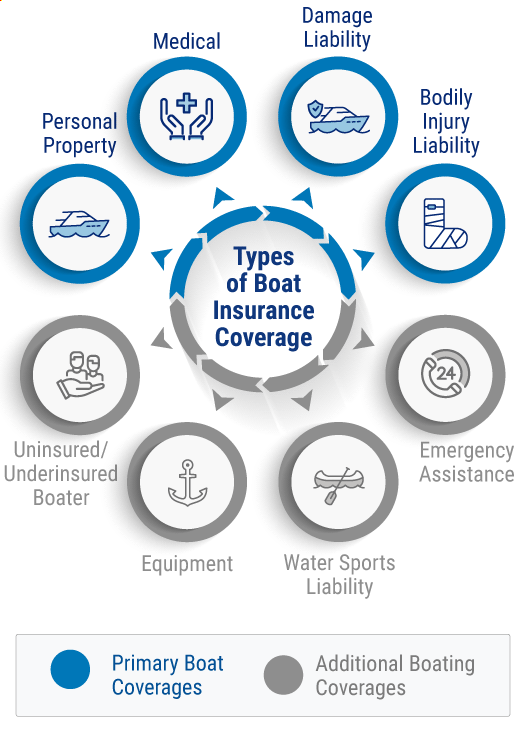

You can typically buy liability insurance — which pays for damage your boat does to others — in amounts from $15,000 to $300,000, according to the Insurance Information Institute. Here's what else you can expect from a policy:

Check, too, about additional coverage for trailers and accessories, for towing and for damage caused by an uninsured boater.

You can buy two types of damage coverage for a boat:

Actual cash value. This pays the value of your boat at the time of the damage. If your boat is destroyed, your insurance company determines its market value.

Agreed amount value. If your boat is destroyed, your insurer pays you an amount that you and the company agreed on beforehand. If your boat can be repaired, your insurer replaces old items for new ones without deducting for depreciation.

It’s also important to understand what your boat insurance covers before heading out on the water, says Todd Shasha, boat and yacht personal insurance director at Travelers Insurance. He recommends checking whether your policy can cover these scenarios:

Mechanical breakdown coverage. Pays to repair or replace your outboard motor as long as it’s not due to wear and tear.

Salvage. If your boat becomes disabled and a basic tow won’t help, you might need to call a salvage company to recover it. Typically a salvage company will ask for a percentage of the boat’s value as payment, which can be quite expensive. Not all insurance companies offer this coverage.

Gadgets. Not all boat insurers cover expensive accessories like fishing equipment or fancy coolers unless they’re permanently attached to the boat. For example, Travelers offers personal property coverage that pays you if they’re stolen or lost while out on the water. Endorsements, which are additions to your policy, are available if you want to increase the value of your personal property limits.

Some important things to know about boating and your policy:

Navigational limits: If you own a yacht or a larger boat, your policy will have limits outlining where you can navigate your vessel. If you venture outside of the territory you agreed to in the policy, your insurance may not cover you. Typically, the broader your navigation area is, the higher your insurance costs will be.

Layup periods: Taking your boat out of the water is typical during cold weather, and most insurance companies will give you a credit because it’s not being used. But take the boat out for a spin before the layup period ends and you won’t be covered by your insurance policy.

Marine inspections: If your boat is an older model, most insurance companies will want you to have it inspected by a marine surveyor in order to assess the vessel’s condition and market value. For safety’s sake, consider a marine survey even if it’s not required.

Underage operators: You might be tempted to let your 12-year-old drive the boat every now and then. But if your child doesn't meet age and license requirements in your state, your boat insurance policy might not cover you. Age and license requirements for operating personal watercraft vary from state to state. In Virginia and Florida, for example, no one under 14 may operate a personal watercraft. In Texas, children under 13 are barred from driving one unless a licensed operator who's at least 18 is on board. For requirements where you live, check with the boating regulatory agency in your state.

How much you’ll pay for boat insurance depends on the level of insurance coverage you want, as well as the size, horsepower, type and value of your boat.

You can choose your deductible, which is the amount deducted from your insurance check if you make a claim. A typical policy has deductibles of $250 for property damage, $500 for theft and $1,000 for medical payments, according to the Insurance Information Institute. Liability claims against you do not have a deductible.

Insurance companies offer a variety of ways to save money, including discounts for:

Having a diesel-powered boat.

Not having made a previous boat insurance claim.

Carrying other policies, such as car or homeowners, with the same insurer.

Taking safety courses.

Boat insurance is widely available. NerdWallet looked at the top 25 auto insurance sellers in the country and found these that also offer boat insurance:

Offers coverage for boats up to $250,000 in value.

AAA lowers your deductible by 25% each time you renew your policy and haven’t had a claim.

Average cost of boat insurance from Allstate is about $20 a month, according to Allstate.

Bundle boat insurance with an Allstate homeowners policy and you qualify for up to a 20% discount.

American Family Insurance

Additional coverage options cover personal items and pay for repairs to your boat and equipment, without a deduction for depreciation.

If your boat is disabled, an Amica policy covers towing to nearest port.

If your yacht can’t be repaired, Amica pays to replace it with a new one, without subtracting depreciation.

Auto-Owners

Optional boat insurance coverage is available through homeowners policies.

Country Financial

Country Financial homeowners insurance covers your boat for up to $1,500.

You can buy more coverage under your homeowners policy.

Erie’s standard Boat Protector Policy comes with extras, including payments up to $500 to fix or replace boating equipment and accessories, and payments up to $250 for emergency towing. (Not available in Kentucky.)

Farmers offers seven packages to fit your vessel type and coverage needs.

Geico’s optional premium boat towing service offers unlimited on-water towing (within 25 miles of an approved tower) and pays the service provider directly.

Geico offers several discounts, including one for passing a boat-safety course and for maintaining a good driving record.

You can cover your boat, sailboat or personal watercraft with an endorsement to your Hanover Platinum or Connections homeowners insurance policy.

The Hartford

Additional coverage, which costs extra, is available for your accessories, trailer and boat hull.

Liberty Mutual

You must have a homeowners insurance policy with Liberty Mutual to get boat and watercraft insurance.

Optional coverage includes hurricane protection, which pays up to $250 to move your boat out of danger during a hurricane advisory.

Unforeseen emergency services coverage pays $250 for towing and other services on land or in the water.

Personal watercraft coverage includes liability, collision, comprehensive, uninsured or underinsured operator, and medical payments.

Optional towing and labor also available.

Progressive

Total loss replacement coverage pays for a new boat if your new boat is a total loss within five years of adding the coverage.

Progressive offers several specialized coverage options, including 24-hour roadside assistance if your car breaks down while towing your boat.

Unlike some insurers, Progressive doesn’t require you to submit a navigation plan. Nor does it require an inspection of your boat.

State Farm’s optional emergency service pays up to $500 to service your boat, motor or boat trailer.

Optional wreck-removal coverage pays “reasonable expenses” to raise or remove your boat when it’s required by law.

Travelers splits the cost to move the vessel to safety when you carry “hurricane-escape reimbursement” coverage, which costs extra.

Antique boats get the same comprehensive coverage available in Travelers' basic policy.

USAA members get a 5% discount on boat insurance, but the discount is not available in all states.

USAA is open only to active and retired military and their families.

Juan Castillo is a former staff writer at NerdWallet.

On a similar note...

Get expert insights delivered straight to your inbox.

How Much Will Boat Insurance Cost Me?

11 Min Read | May 29, 2024

Boats are a highlight of summer! They’re flashy, fun . . . and freaking expensive to repair or replace. That’s why it’s better to pay for boat insurance than to hope you’ll get by with zero accidents.

Boat insurance protects you financially if your boat is involved in an accident where property gets damaged or someone gets hurt. On average, boat insurance costs $200 to $500 a year—or around 1–5% of your boat’s value if you have a big, powerful or expensive boat.

Let’s talk about what affects the average boat insurance cost, what it covers and where to get it.

Do I Really Need Boat Insurance?

That depends on your boat. A standard homeowners insurance policy will generally cover small, inexpensive watercraft like:

- Paddle boats

- Boats with low-powered engines (usually less than 25 horsepower or less than 25 mph maximum speeds)

You can also add a liability rider to your homeowners insurance to cover property damage or injuries if you get in an accident with another boater.

But homeowners policies won’t cover big, powerful boats. You’ll need boat insurance for:

- Charter Boats – Since your boat is your business, you may also need commercial insurance .

- Fishing Boats – including bass boats, fancy offshore rigs and everything in between

- Houseboats – Just like insuring a regular house , you need to insure your home on the water too.

- Personal Watercraft – Watercraft like jet skis are super fun, but they’re also risky—hence the insurance.

- Pontoons – Pontoons are where the party’s at! So make sure your boat and your passengers are protected.

- Sailboats – Activities like long distance travel, racing or historical reenactments require special coverage. Think of sailboats as the classic cars of the sea.

- Speedboats – Fast boats are at higher risk for accidents—which makes insurance a must.

- Yachts – Luxury vessels need insurance because they’re more valuable and travel farther than most other boats.

All these boats need insurance even if it isn’t required by state law. Why? Because if you’re uninsured, a boating accident can ruin your future—in more ways than one.

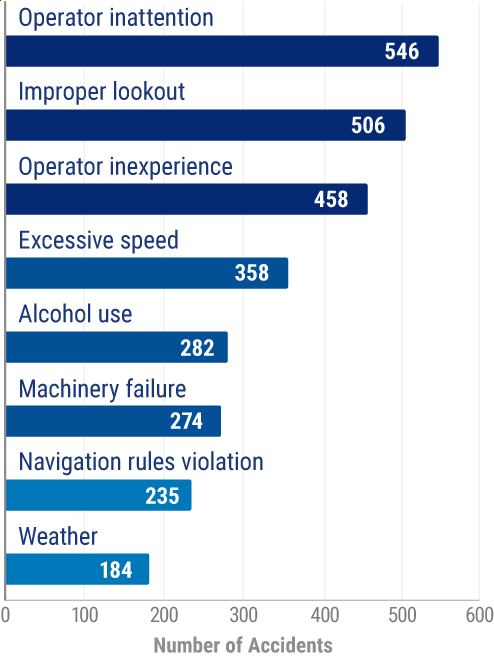

Boating accidents caused $55 million in property damage in 2019—and that’s not counting medical bills and lost wages for the 2,559 people who got injured. To make matters worse, 613 people died in boating accidents that year. 1

If you cause those damages, injuries or (God forbid) deaths, you’ll be held liable. That’s why boat insurance is so important: It protects you financially after an accident, so you can focus on more important things.

How Much Is Boat Insurance?

The average cost of boat insurance is $200 to $500 a year—although for a really big or expensive boat (like a yacht or sailboat), insurance can cost around 1–5% of the boat’s value. For example, you may pay about $2,500 a year to insure a $100,000 yacht.

But just like other insurance rates vary, boat insurance costs change depending on you and your boat.

Get trusted coverage that fits your budget.

When you work with a RamseyTrusted pro, you can feel confident knowing they’re going to find the best policy for you at the best price.

What Factors Affect Boat Insurance Costs?

Many of the factors that affect car insurance rates also affect boats—but there are also some unique things to consider for watercraft.

Type of Boat

The more valuable a boat is, the more expensive it is to insure. For example, yacht insurance almost always costs more than pontoon insurance because yachts are more expensive.

High-powered watercraft are riskier, so insurance companies look at the type of motor (inboard or outboard, amount of horsepower and so on). Slow and steady usually wins the race to get low insurance rates!

To be considered in good condition, your boat must meet the U.S. Coast Guard safety standards from the time when it was built. Otherwise, you’ll pay higher premiums because of your boat’s outdated safety features.

Your boat’s age matters—and so does yours.

Older boats are generally cheaper to insure, especially if they’ve only had one owner. You’ll probably also get better rates if you’re between 25 and 60 years old, because that’s when insurers think you’re the most responsible.

Fishing and floating are lower risk than towing water skis or wakeboards. If you use your boat for “risky” activities, your insurance company will charge you higher premiums to make up for the accident they expect you to have.

Boating accidents almost always happen on the water (duh). So if you occasionally take your boat out, you’ll pay less than if you boat every weekend. That’s also why people who live up north typically pay less for boat insurance—the shorter boating season means less time for accidents.

Speaking of where you live, you’ll pay higher premiums for boating in an area with hurricanes (on the ocean), squalls (in the Great Lakes) or other hazards. And you’ll pay less if you live in a state with no coastline. That’s because lakes and rivers are typically safer than the ocean.

Driving Record

You’ll likely get low rates if you’ve got a good driving record (aka no accidents, injuries or recent insurance claims in a boat or car). But your inexperienced teen or your reckless cousin who’s totaled three cars? Not so much.

What Boat Insurance Discounts Can I Get?

There are a lot of ways to save money on boat (or even car) insurance. You can get discounts if you:

- Take boating safety classes

- Use a diesel-powered engine

- Carry ship-to-shore radios, Coast Guard approved fire extinguishers and other safety equipment onboard

- Bundle your boat, home and auto insurance

- Pay your insurance yearly

- Choose a high deductible

- Don’t file a claim for at least two years

What Does Boat Insurance Cover?

Boat insurance covers many costs of an accident—like repairs, salvage and medical bills. Let’s walk through the types of coverage you can get.

Liability is the most important type of boat insurance. It pays for the other person’s repair and medical bills after an accident you caused. And if someone sues you? Your liability coverage should help pay the legal fees.

You can even look into guest passenger liability , which covers you if someone driving your boat with your permission causes an accident

Liability also covers repairs to docks or other objects you hit—plus clean-up costs for oil and other pollutants that your boat released into the water. (Which is good since cleaning up even a small oil spill is insanely expensive.)

Without liability coverage, you’ll have to pay for damages to boats, docks, personal property, a person’s health or the environment. That’s a lot of money. So play it safe and let the insurance company pay instead.

Physical Damage

Physical damage coverage pays to repair or replace your boat if something bad happens to it, like:

- Collisions with other boats, docks, submerged objects or floating debris

- Damage from wind, hail, lightning or other weather

- Theft or vandalism

You can even get an “all risk” policy: Unless a risk is specifically excluded, your insurance will cover anything that happens to your boat—even sinking.

How much your insurance company will pay to repair or replace your boat depends on what type of physical damage policy you choose.

Agreed Value Policy

You and the insurance company work together to decide how much your boat is worth—and that’s the most your insurer will pay you after a covered accident. So if your sailboat’s agreed value is $95,000, your insurer will pay up to $95,000 to replace or repair it.

Agreed value policies offer plenty of coverage for most boats. But if you own a rare boat that’s increasing in value, it will eventually outgrow the agreed value you chose. That’s where the next type of policy comes in.

Actual Cash Value Policy

This policy pays up to the boat’s market value on the day it got damaged. That means you should be able to restore your boat or buy a similar one. You just won’t be able to upgrade on the insurance company’s dime.

For example, let’s say your boat is worth $12,000 and it sinks. The insurance company will only pay you $12,000—even if you originally paid more to buy the boat.

Medical Payments

This coverage helps pay for medical expenses if you or your passengers get hurt on your boat. It can cover all sorts of injuries from a collision with another boat or even taking a nosedive on water skis.

Personal Property

Personal property coverage helps replace the unattached accessories that made your boat so much fun in the first place—like your fishing gear, navigation system and personal items.

You can even get insurance for your boat trailer (which may be helpful if you’re new to towing trailers).

Uninsured Watercraft

Imagine that a speedboat makes a huge wake and pushes your boat into some sharp rocks. Your boat is damaged—but the other guy is uninsured. Yikes!

Uninsured watercraft coverage will help pay for your repairs (or medical bills if you or your passengers get hurt). That’s much easier than suing the other boater or—worse—having to foot the bill yourself.

If your boat becomes disabled on the open water, you’ll need to get it towed back to land. That’s what salvage insurance helps pay for.

You can also get insurance that helps pay to remove your boat from the water if it sinks—otherwise, the wreckage could become a hazard to other boaters and cause even more accidents.

What Boat Insurance Doesn’t Cover

One thing boat, home and auto insurance all have in common: They don’t cover every situation. Here’s what boat insurance doesn’t cover.

Normal Wear and Tear

Boats get old and wear out just like any other machine. So your insurer won’t pay for cosmetic or mechanical issues that come from normal use.

Faulty Machinery

While your insurance policy might cover a mechanical breakdown if it’s out of the ordinary, it won’t cover manufacturer defects or things that broke because you used them wrong or didn’t take care of them. (So you may want to clean out that clogged water pump now.)

Animal Damage

Animals can be a big boating hazard—literally. If a run-in with a dolphin, manatee or other marine animal damages your boat, your insurance policy most likely won’t cover it.

(By the way, it pays to know what animals live in your boating area so you don’t harm them, your boat or the environment.)

Infestations

Another animal that’s not covered? Mussels! These little guys can do major damage. But the insurance company won’t pay for it—or damage from insects, mold or other infestations. It’s smart to check your boat and remove any unwanted passengers.

Improper Storage and Transportation

Your boat falls off the trailer because you didn’t tie it down? Your “winter storage” is in the yard? Your insurance company will chalk those damages up to your careless behavior and make you pay the bill.

Accidents Beyond Your Navigational Limits

Your navigational limit is where you and the insurance company agree you can boat. Your insurance policy only covers you in that area. Sail outside of it, and you’re on your own.

Accidents Outside Your Layup Period

A layup period is when you take your boat out of the water for a while (usually the winter). If you use your boat after your layup starts or before it’s over, you won’t be covered.

Underage or Unnamed Operators

Each state makes its own rules about how old a kid has to be before they can drive a boat, so check the local laws before letting them take the wheel. And if your child (or another adult) drives your boat regularly, it’s smart to put their name on your insurance policy.

Where Do I Get Boat Insurance?

The easiest way to get boat insurance is to work with an independent auto or homeowners insurance agent.

Our network of Endorsed Local Providers (ELPs) will compare policies from multiple insurers to find the best one for your boat. And our agents will go a step further: They’ll teach you how to actually understand your boat insurance policy so you can be confident you’re getting the insurance you need—without costly extras.

Connect with an agent near you today.

Get coverage you can trust.

When a RamseyTrusted pro is in your corner, you have an insurance guide you can trust who will give you confidence in your coverage.

Did you find this article helpful? Share it!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

How to Save on Car Insurance: Smart Ways to Lower Your Rate

Car insurance rates skyrocketing? Trying to figure out how to save on car insurance? Check out our list of 11 ways to knock your premiums down.

What Is Commercial Insurance?

Fire? Theft? Tornadoes? Cyberattacks? Killer bees? All these and more could take out your business if you don’t have the right commercial insurance (ok, maybe not that last one). Get educated about what you need to protect your business’s needs.

To give you the best online experience, Ramsey Solutions uses cookies and other tracking technologies to collect information about you and your website experience, and shares it with our analytics and advertising partners as described in our Privacy Policy. By continuing to browse or by closing out of this message, you indicate your agreement.

- Yachting for beginners

- Owning a yacht

- Motor Yachts

- Sailing Yacht

- Indian Ocean

- Mediterranean

- Buying or Selling a Yacht

- Yachting Events

- FAQ – Luxury Yacht Charter

- FAQ – Buying a Yacht

- FAQ – Sell your Yacht

- How Much Does It Cost To Charter A Luxury Yacht?

- All our Blog Post & News

Yacht Insurance: The Definitive Owner’s Guide

A sailing vessel’s indemnification liability coverage is provided through yacht insurance, and it covers any damage to the yacht’s body, property destruction of others, and private property damage aboard the vessel. This insurance may also cover gas supply, towing, and help if your boat gets stuck, depending on the insurance company.

Understanding The Two Parts of Yacht Insurance

Hull insurance.

Hull insurance is a direct and all-risk insurance policy that covers damage and includes an agreed amount of hull insurance. The amount settlement is done when the policy is drawn up, and the payment is in full in the event of a total loss. In addition, there’s the possibility of replacement costs insurance for partial losses. Still, sails, batteries, canvas outboards, and sometimes outdrives aren’t covered and are instead at risk of depreciation.

Indemnity and protection (P&I)

Protection and indemnity (P&I) insurance provides the most comprehensive insurance coverages for liability. Because maritime law is unique, you must have coverages specifically designed to protect you from risk-taking situations. P&I will cover any judgments against you and pay to defend you in admiralty courts.

What are the factors that can influence your yacht insurance?

Insurers consider many factors when deciding whether to offer a policy.

Almost any vessel can be insured – for a price. You should consider the following to make sure the policy you buy meets your needs:

- Age of the vessel

- Value (make sure you consider depreciation over the years of the value of your yacht)

- Speed/Power

- Type of vessel (Sailing, motor, Inboard, Outboard, utility, cruiser, offshore fishing boat)

- Custom built (boats without serial numbers can be tricky to insure)

- Location of use (which ocean are you planning to locate your boat. Make sure you let your insurance know whenever this changes over the months!)

What does yacht insurance usually cover?

Usually, the yacht insurance covers:

Liability protection: the bare minimum insurance

Property damage liability pays for damage to another person’s property caused by the accident you commit. You are covered if your yacht causes damage to individuals or damages other ships, docks, or buildings. Remember that harm or damage might occur due to direct contact with your boat or events induced by your yacht, such as during heavy wakes. In most cases, boat liability insurance covers you against covered claims and litigation involving settlements and legal expenses. To ensure that you have the right coverage, talk to your advisor regarding your needs and potential dangers.

Hull and machinery coverage

Hull insurance will cover any physical injury to your boat, including motors, trailers and equipment, and even accessories in many instances. Damage from wind and fire are typical claim types.

Uninsured boater coverage

Indemnifies bodily injured passengers of the insured watercraft who suffer injuries due to the uninsured owner of a different vessel.

Search and rescue

The maximum amount is $10,000 for costs that an insured incurs to a government entity like the United States Coast Guard (USCG), which provides emergency assistance and is covered at absolutely no cost.

Marine environmental damage and pollution coverage

This protection is available up to $10,000 in penalties and fines in the event of marine environmental damage as per the policy’s conditions. This coverage is added to the insurance company’s liability and OPA limit.

Agreed value coverage or actual cash value coverage

A cash value policy offers lower coverage than an agreed value insurance policy, however, generally with a lower cost. ACV policies provide coverage up to the value of the vessel. ACV policy would protect up to the price of the market for the boat if there was a complete loss, including depreciation and conditions of the vessel when it suffered the loss.

Crew medical and personal coverage

Reasonable medical and related costs are covered for all onboard passengers leaving or boarding the vessel. These benefits are granted per person instead of per event.

If your vessel gets damaged by accident, collision insurance is an optional insurance policy that covers the cost of fixing and replacing the damaged part with less deductible.

Sinking and wreck removal

Insurance for boats generally can cover sinking. However, there are some critical policy limitations. In general, insurance for boats should protect your boat if it sinks due to any covered risk. The policy could reimburse you for the cost of salvage or removal.

What is usually excluded from yacht insurance policies or comes as an extra?

War coverage

Damages caused by acts of war can turn out to be too great to insure, making the repayment too astronomical to be true.

Hurricane insurance

Your boat insurance provider may be able to pay for damages to your vessel caused by wind and hail from a storm in the event of a hurricane unless stated explicitly in the policy. Contact your boat insurance provider to find out what coverage you have during a storm.

Marine life encounters

Most insurance for boats doesn’t provide coverage for marine-related damage such as sharks, whales, and many other species. If you frequently sail in water full of marine creatures, it is possible to discuss a supplemental insurance policy with your insurance provider.

Insects and mold

The majority of yacht insurance policies do not cover insects and mold. It is essential to take the necessary steps to safeguard yourself against any pests on your vessel. So, this means that you must wash, drain, and dry your boat’s equipment after use.

Toys and PWC onboard

The PWC onboard may need to have a separate insurance policy as it is an expensive purchase.

Negligence or criminal acts

No insurance company is accountable for paying for the illegal actions of other people. Damage or loss due to reckless negligence and incompetence is also not acceptable.

Most insurance coverage for boats won’t cover certain events, such as racing on a yacht. Suppose you plan to use your boat to compete. In that case, you might want to consult your insurance representative about supplemental insurance, precisely the possibility of additional liability insurance if there’s a crash in the course.

Kidnapping and ransom

Because of the high stakes involved – human life and assets such as vessels and cargo — as well as the criminal character and challenging legal context, resolving a hijacking or abduction for ransom is a difficult task. Hence, kidnapping and ransom are not included in yacht insurance.

What do you need to know before picking a yacht insurance policy?

When evaluating physical damage cover, the most significant question is whether the insurance is focused on “agreed value” or “actual cash value” damage payout. If there is a complete loss, most agreed value coverage covers the amount shown on the insurance contract. After depreciation, you will receive compensation.

The actual cash value coverage offers protection up to the vessel’s present market worth at the moment of complete loss, after depreciation and the deductibles.

Although the coverage is smaller in an actual cash value insurance than in agreed value insurance, the policy is generally inexpensive.

The next thing you want to consider while choosing your insurance is the deductible and premium.

The amount you self-insure in the case of a loss is your yacht insurance deductibles. Put another way, it is the amount you spend on claims before your insurance comes in.

The next is premium. Choose insurance that can fit your budget to pay your premium on time without fail.

Another thing to consider is the Intended cruising area. Some policies put restrictions or have a defined area while cruising. So, choose an insurance policy that suits your cruising area so that in case of mishaps, you can get coverage.

Yacht Insurance Requirements

Is yacht insurance mandatory?

While it’s not usually a legal necessity, it is always a good idea. It’s unlikely to cost much, but it might save you a lot of money in a disaster. Even if you or your captain are the finest sailor on the planet, you must consider what would happen if someone else collides with your yacht.

Changing weather may damage your boat, yet you usually have little control over it. Fortunately, most yacht insurance policies aren’t too costly, and the modest additional cost may provide comfort while cruising on the sea.

Does the bank require insurance while you finance the yacht?

Yes, your bank may require proof of yacht insurance if you want to finance the yacht.

Do ports and marinas need your yacht insurance?

For utilizing their facilities, numerous ports and marinas will need you to have boat insurance.

Does renting the yacht require insurance?

If you intend to rent out your yacht, you must have coverage to safeguard your asset, and yacht insurance can be highly beneficial. If you want to rent your yacht, you must get boat insurance to protect yourself from liability hazards, and the insurance covers the majority of liability concerns.

Read also : The yacht charter experience ladder

How much does a yacht insurance cost?

Usually, yacht insurance costs between 1% and 5% percent of the yacht’s value. For instance, you may spend around $2,500 annually to insure a boat worth $100,000.

However, similar to other types of insurance, the cost of your boat insurance depends on you and your vessel. The higher the value of a boat, the greater the insurance cost. Yacht insurance is often costlier than floating insurance since yachts are more expensive. High-powered boats are riskier. Thus, insurance companies consider the kind of engine (inboard or outboard, amount of horsepower, and so on).

How can I lower my yacht insurance cost?

Here are a few steps that you can take to lower your insurance cost.

Limit the cruising area of your yacht

There are navigational restrictions in marine rules, meaning you may only sail inside a specified region. The premiums will be less the smaller and securer the area is.

Have good training and driving records

Insurance companies are interested in your expertise on the water. The completion of a boating course demonstrates proficiency, which reduces your risk. Most insurance companies would consider boating lessons, but they may even provide a rate reduction. Contact your agent to determine whether safety-related boating classes impact your premium rates.

Lower the liability limits

Most insurance companies will require your credit score to establish suitable premiums. Maintaining a good credit score has several advantages, including cheaper insurance prices. To lower your liability limits, consider working on your credit score.

Pick a higher deductible to reduce the premium of your insurance

A greater deductible implies that the policyholder will be responsible for a percentage of the claim, hence decreasing the occurrence of claims. You choose to pay a part of the claim by raising your deductibles out of your cash, and the company will eagerly reduce your premium.

Choose seasonal insurance during the offseason

Fire, theft, vandalism, and winter storms can all cause significant damage and financial burden. You won’t be insured for any winter tragedy that strikes your yacht during the off-season if you don’t have insurance. You’ll be responsible for possibly astronomical expenditures.

Pick a modern boat rather than an old one

A new yacht will cost less to insure than an older one. This is because older ones are susceptible to acquiring defects, while newer ones are not. Further, you can take several steps to improve your yacht’s safety, contributing to lowering your cost. Like, installing an autonomous fire control system may decrease the danger of fire damage and make you eligible for a premium reduction. Additionally, safety devices like radar, depth finders, first aid kits, GPS, emergency kits, and EPIRBs may reduce the danger.

Our advice to find the best insurance broker at the best cost for a yacht

Avoid using your home and car insurer for yachts above 27”.

Usually, boat insurance is meant for vessels less than 26 feet long. Yachts are generally longer than 27 feet, have far more powerful engines, and cost more than smaller vessels.

Yachts typically go greater distances and deeper seas, transport more passengers, need a crew and have several equipment and personal possessions. These variables result in distinct risk exposures and need particular insurance policies, coverage choices, and deductibles.

Maritime law governs rather than state or federal law in deeper seas, which may be more complex. If your boat has a crew, you might be obliged to have Harbor workers and Longshoreman’s covers.

Partnering with an advisor who knows the worth of your boat and how you intend to use your boat can assist you in getting the necessary coverage for any potential catastrophes. You will also need specific insurance coverage if you own a high-performance boat due to the increased risk.

Pick a trustable company with expertise in marine insurance

You can choose your regular insurance provider to get your marine insurance. There are several maritime governing rules when you decide to sail on the sea or plan to sail overseas. Additionally, it is essential to engage with a provider that has a deep understanding of boat and yacht coverage. This is vital at the time of insurance application and in the severe case of a claim.

Special needs might require custom policies

If you have any special needs, additional coverage choices are available for medical costs, private possessions, the boat’s transportation equipment, and more that may be added to any plan. However, that relies on the type of insurance provider you choose.

Optional coverage extensions:

- Trip disruption

- Private property

- Trailer Coverage

- Towing and Emergency Roadside Service

- Uninsured Watercraft

- Individual Liability

Get an experienced yacht broker to help you navigate policies.

You may have 100 policies in front of you and many lucrative offers claiming several things. Yet, making the right insurance takes time and a better understanding of all the coverage. So, an experienced broker can help you navigate all these policies and select one that fits your budget and particular situation.

The best companies for yacht insurance

Many insurance firms provide boat insurance at affordable prices. Shop around to ensure that you receive the necessary information to make an educated selection. Also, there are several websites that offer evaluations of various insurance providers and are excellent starting points for your study.

Communicate with other sailors; determine which aspects they value and why. You would be in a position to make the most excellent option for your requirements when you analyze the services of various companies.

Being on the ocean is a feeling of serenity, tranquility, and impending new experiences. So, this is an encounter you want to go on forever. Further, your sailing boat is a significant investment. Hence, consider having your luxury boat insured to cherish the best of life and keep your investment safe.

Don’t take chances with your yacht, act now and ensure a safe and worry-free sailing experience

Now that you understand the importance of yacht insurance, don’t wait any longer to protect your valuable asset. Contact us today to get a quote and secure peace of mind on the water. Our team of experts will guide you through the process and help you choose the best coverage for your needs.

Frequently Asked Questions

All ship and yacht owners are obliged to have marine insurance, mainly when the vessels will be utilized for commercial or transit reasons and move people, labor, or goods overseas.

our yacht insurance usually protects your yacht against frequent dangers such as drowning, storm, fire, collisions, and theft. You may also be protected by boat insurance if you accidentally harm somebody or destroy their property. Your coverage may cover the following boat components: machinery, attached equipment, hull.

The exclusions from yacht insurance policies include: criminal actions of others, insect infestations, lack of due diligence on the part of the assured or managers, common wear and tear, loss resulting from delay, and intentional wrongdoing by the captain or crew.

The typical cost of boat coverage is between $200 and $500 per year. However, insurance may cost between 1 and 5 percent of the boat’s worth for a yacht or sailboat. For instance, you may spend around $2,500 annually to insure a boat worth $100,000.

Sailboat owners often spend between $250 and $1,500 annually to protect their yachts. This price varies depending on various criteria, including insurance type and insurance amounts, and sailboats usually are less costly to cover than powerboats.

Annual insurance on the yacht will range at roughly 1.5 percent of the boat’s value. The cost to insure a catamaran depends on hull valuation, location, and the boat’s operation.

The insurance coverage of a mega yacht or a super yacht can be around $240,000.

To reduce the cost of yacht insurance, you can take the following steps: installing safety equipment, demonstrating better boat riding skills by undertaking a boating course, considering your deductibles, limiting your sailing area or working on credit scores.

Hull relates to the vessel’s body. The insurance will cover unexpected damage or loss to the boat anywhere inside the policy’s specified maritime boundaries.

Usually, classic boat insurance is provided by specialized insurance firms who specialize or have experience in protecting classic and antique vessels. For covering your old boat, get a quotation from a specialized insurer and verify that your policy provides the protection you want for a sense of security.

Luxury Yacht Charters in Croatia : Our Guide

Mediterranean islands: our ultimate guide, you might also like.

What differentiates a yacht from a superyacht or a mega yacht?

Chartering Requirements and Regulations: A Guide for Boat Owners

What are the Fastest Cruising Catamaran on the Market?

How Much Does Boat Insurance Cost?

Table of Contents

Last Updated on March 23, 2022 by Boatsetter Team

Nearly half of boats are uninsured primarily due to high premiums and deductibles, but boating without insurance is the same as driving without it—it’s very risky and in some states, it’s illegal. Let’s look at when you need insurance and how much its’ likely to cost.

Own a Boat? Learn How to Offset the Cost of Ownership by Listing on Boatsetter

Average Boat Insurance Costs: Per Month and Per Year

As a responsible owner, your boat should be insured from the minute you take ownership or control of it. Boat insurance costs vary and can run from $500 per year for smaller boats to thousands of dollars for large yachts.

A rule of thumb is that annual premiums will total 1 to 3 percent of the value of the vessel.

- For example, a $50,000 boat will have annual premiums of $500 – $3,000 and a policy for a $200,000 boat will cost $3,000-$6,000 per year. This doesn’t hold for very large yachts where the percentages as well as the absolute numbers rise dramatically.

- Big yachts will have additional equipment and possibly professional crew , or they may be chartered all of which adds to the overall coverage costs.

You can buy boat insurance online or get a quote from specialized agents like GEICO/BoatUS , who may also be able to provide a boat insurance calculator to get you started.

How Much Should I Insure My Boat For?

There are several factors that will dictate how much you should insure a boat for:

- Size, vessel type and value

New or pre-owned

- Where you will be boating

Size, type and value

Bigger and more expensive vessels will require higher insurance coverage limits and higher premiums. Also, high performance boats (like fast cars) command a premium because of the risks that go with the kind of boating they engage in.

New boats are easier to insure because presumably, there are fewer risks of equipment failure. However, the coverage for new boats may be more expensive simply due to the higher value of the vessel itself.

How much does it cost to insure a used boat? Well, that depends. An insurance company may require a current survey to make certain that the boat is in a seaworthy condition. Surveys cost money and the premiums for older boats may be higher or lower depending on the boat’s condition. Some insurers won’t cover boats older than 20 years.

Cruising grounds (where you’re be doing most of your boating)

Boat insurance costs will vary by state with some being much higher than others. If you boat in waters that are known for hurricanes , you may have to add coverage in certain seasons and geographies. If the boat will be stored ashore for an extended period, you may qualify for a discount.

Outside of insurance, be sure to read our guide outlining the costs of boat ownership and what expenses you can expect.

Why is Boat Insurance So Expensive?

There are risks that go with boating—collision, onboard damage, injury, environmental impact, etc. There are fewer experienced boaters on the water than there are drivers on the road so boat insurance costs can be steep.

How Can I Lower My Boat Insurance Costs?

Some insurers will offer a discount for having multiple policies with the company, for having a good driving record, for paying a year’s worth of premiums up front, or for the owner/operator completing boating safety courses. You can also opt to lower monthly premiums by raising the deductible.

Commercial Boat Insurance, Peer-to-Peer, & Charters

Insurance costs rise when the boat is chartered or used for commercial purposes, because it’s expected that it will be used more frequently and will carry paying passengers.

This extends to peer-to-peer boat rentals, like Boatsetter rentals, where private owners lease their boats with or without a captain. If decide to become a Boatsetter owner and list your boat for rent, you’ll have peace-of-mind through coverage provided by the company’s exclusive peer-to-peer boat rental policy provided through GEICO/BoatUS .

So, is Getting Boat Insurance Worth It?

Absolutely. Accidents happen so whether there are medical costs, expensive property damage, legal fees or the cleanup of an oil/fuel spill, you’ll want the boat you rent or buy to be covered.

Earn an Average of $20,000 or More by Listing Your Boat for Rent on Boatsetter

Zuzana Prochazka is an award-winning freelance journalist and photographer with regular contributions to more than a dozen sailing and powerboating magazines and online publications including Southern Boating, SEA, Latitudes & Attitudes and SAIL. She is SAIL magazines Charter Editor and the Executive Director of Boating Writers International. Zuzana serves as judge for SAIL’s Best Boats awards and for Europe’s Best of Boats in Berlin.

A USCG 100 Ton Master, Zuzana founded and manages a flotilla charter organization called Zescapes that takes guests adventure sailing at destinations worldwide.

Zuzana has lived in Europe, Africa and the United States and has traveled extensively in South America, the islands of the South Pacific and Mexico.

Browse by experience

Explore articles

5 Best Ocean Boats

Small Boats: What Type is Right for You?

Lady Bird Lake Fishing Guide

How Summer Days With my Father on Fox Lake Led to Founding Boatsetter

- Buying and Selling Boats

- What Should You Expect To Pay For Boat Insurance?

What Should You Expect to Pay for Boat Insurance?

In some areas, boat insurance is mandatory. In other areas, it's not required, but it's still a good investment. If you're shopping for a boat, you should also be shopping for boat insurance. But what exactly should you look for in a boat insurance policy? And how much can you expect to pay for a typical premium?

The Average Cost of Boat Insurance

Let's start by looking at the average cost of boat insurance, applied broadly.

Progressive calculated average boat insurance premiums in the United States using data from 2020 and 2021 – which is still fairly accurate for getting an initial estimate.

Overall, you can expect your boat insurance premiums to amount to between $245 and $652 every year, which equates to about $20 to $54 every month.

If you live in a high-cost state, you can expect an annual premium of $527, or $44 a month. Alabama, Alaska, Connecticut, Delaware, Florida, Hawaii, Louisiana, Maryland, Massachusetts, Mississippi, Nevada, New Jersey, New York, South Carolina, Rhode Island, and Texas.

If you live in a medium cost state, you can expect an annual premium of $344, or $29 a month. These states include Arizona, California, Georgia, Idaho, Kentucky, Maine, Michigan, New Mexico, North Carolina, North Dakota, Oklahoma, Oregon, Tennessee, Virginia, Washington, West Virginia, and Wyoming.

If you live in a low-cost state, you can expect an annual premium of $263, or $23 a month. These states include Arkansas, Colorado, Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, New Hampshire, Ohio, Pennsylvania, South Dakota, Utah, Vermont, and Wisconsin.

What accounts for the differences here?

Obviously, cost of living plays a bit of a role here, but you've also likely noticed something similar about the states that are grouped together. States that are closer to accessible water, and those with more aquatic options, tend to be more expensive, for understandable reasons.

In Europe, you may have to consult some conversion tables, but the rates are somewhat similar. The average annual premium of comprehensive boat insurance for a yacht in the UK, for example, is £380 , putting it somewhere between a medium cost and high cost U.S. state.

Variables That Influence Your Boat Insurance Costs

There are many different variables that are going to influence your boat insurance costs. The estimates in the preceding section can help you get a baseline for the premiums you can expect, but only by factoring in these variables will you be able to get a more accurate estimate.

- Location. Where you live matters. Some areas are home to highly popular, densely packed oceans, lakes, and rivers, where you can take your boat out frequently at a moment's notice. But if you live 100 miles away from the nearest body of water, and you're only going to take your boat out 2 or 3 times a year, you're going to pay much less for your insurance.

- The nature of your boat. The manufacturer and type of boat that you have is also going to influence your insurance costs. As you might imagine, bigger boats are more expensive to insure. More expensive boats are also more expensive to insure. And if your type of boat is associated with more accidents than other types of boats, you can expect your premiums to increase.

- Boat age. Insurance companies will also consider the age of your boat. The older the boat, the riskier the asset becomes, and the more expensive it becomes to insure.

- Boat horsepower. Boat horsepower can also influence the cost of your premiums. The faster and more powerful the boat is, the more damage it can do if it's ever involved in an accident. Fast boats are often highly correlated with accidents in general, since the people driving them may be looking for a thrill and may be more tempted to engage in risky activity.

- Personal boating history. Of course, that can be mitigated by your personal boating history. If you've owned and operated boats for 25 years, and you've never had to make an insurance claim, your premiums are going to be less expensive than someone who's completely new to boating, but they've already been in three boat accidents.

- Driving record. Many insurance companies will also take your driving record into account, as an indicator of your level of safety and responsibility. If you have a long history of automobile accidents, you can expect your boat insurance premiums to be higher.

- Safety equipment present. You can get a discount on your insurance policy, in many cases, simply by having more safety equipment onboard. Your insurance agent will ask you lots of questions about your safety equipment and safety precautions – just be sure to answer honestly.

- Other risk factors. Insurance underwriters often look at other risk factors as well, hoping to accurately estimate your risk of being in an accident. The higher the risk, the higher the premium.

What Should Your Boat Insurance Policy Include?

The two main types of boat insurance are agreed value and actual cash value policies. Agreed value policies are based on the value of the boat whenever the policy was written; it doesn’t factor depreciation into the equation, but you’ll typically pay more upfront. Actual cash policies are based on the current value of your boat, even as it declines through depreciation.

Many boaters choose an “all risk” policy, which covers many – but not all – types of losses. In this type of policy, the policy will cover anything that’s not explicitly omitted. Frequent omissions here include things like marring, denting, ordinary wear and tear, damage from animals, manufacturer defects, and ice damage.

You can also choose additional coverage for things like medical payments, coverage for uninsured boaters, liability coverage, and coverage for towing and assistance.

No matter what, it’s important to read your policy carefully to make sure you understand what it covers and what it doesn’t.

Thankfully, most boat insurance policies are relatively inexpensive. Even at the upper end of the spectrum, with annual premiums exceeding $500, the fact that a robust policy can save you tens of thousands of dollars or more makes it more than worth it. If you’re looking for your next boat to insure, check out our vast selection of new and used boats for sale today !

Share this article

You might like.

Sign up to our newsletter

By submitting this form, you agree to our Privacy & Cookie Policy

Change units of measure

This feature requires cookies to be enabled on your browser.

Show price in:

Show lengths, beam and draft in:

Show displacement or weight in:

Show capacity or volume in:

Show speed in:

Show distance in:

When you use links on our website, we may earn a fee.

Best Boat Insurance of 2024

Boat insurance is a type of coverage designed to protect boat owners and their personal property in the event of an incident on the water. The best boat insurance companies offer flexible coverage options for a variety of vessels, with reasonable premiums and lots of additional benefits.

Every person who owns or operates a boat should consider carrying boat insurance , as it protects them against personal liability if they’re in an accident, as well as guarding them against loss if something happens to their vessel. In this guide, we’ll explore some of the best companies that offer boat insurance, what they offer, as well as their benefits and drawbacks. We’ll also discuss special coverage options for particular use cases or types of boats.

Table of Contents

- Best Boat Insurance

- How to Find

- How to Save

Geico Marine »

Insures boats up to 50 feet in length

Gives policyholders access to BoatUS Catastrophe Team

Insures boats valued up to $2.5 million

Doesn’t insure wood or composite boats

Boats more than 40 years old aren’t eligible for coverage

Geico Marine has been writing boat insurance since the 1980s. Originally established as Seaworthy Insurance, the company was bought by financial giant Berkshire Hathaway in 2007.

Under the Geico umbrella, Geico Marine offers insurance designed to meet the needs of the vast majority of boat owners. The list of boats that are ineligible for coverage by Geico is far shorter than those that are. Disqualifying criteria include:

- Boats over 50 feet in length

- Boats over 40 years old (15 years for houseboats)

- Multihull sailboats (catamarans)

- Watercraft made of wood or composite material

- Homemade boats

- Amphibious land boats or hovercraft

- Boats previously deemed a total loss

- Boats valued over $2,500,000

In addition to its strong lineup of coverages, Geico Marine insurance also comes with 24/7 assistance. Additionally, the company has a long-standing association with The Boat Owners Association of the U.S. (BoatUS), including giving policyholders access to the BoatUS Catastrophe (CAT) Team. The BoatUS CAT Team is a group that brings considerable resources to bear – including towboats and cranes – to help BoatUS members and Geico customers recover and salvage their vessels after a natural disaster.

Coverages Offered: |

Special coverage for rods, reels, and other equipment

Emergency towing and personal property coverage included

Lift and trailer coverage available

Claims can take a few weeks to settle

Some negative customer reviews online

Specialty insurer Markel is another provider of boat insurance. Markel boat insurance policies come with multiple coverages included and even more optional coverages available, including many not available from other insurers. Several of these special coverages are geared towards fishing enthusiasts, including both amateurs and professionals.

Among Markel’s special coverages for fishers are protections for rods, reels, and other personal effects, plus coverage for boat lifts and trailers. The company even offers professional angler liability coverage and tournament fee reimbursement as optional add-ons.

However, according to Markel’s documentation and customer reviews online, the company can take up to several weeks to settle claims. This is somewhat longer than some other providers. Customers have also noted that claims can take longer and be more involved, increasing the time it takes to get boats repaired or replaced.

Coverage designed specifically for yacht owners

High coverage limits available for captained vessels

Vessels must be 36 feet longer or greater to qualify for yacht coverage

Crew required for vessels over $3 million

Global insurer Chubb is one of the few large carriers that offers boat insurance designed specially for yachts, including those over 70 feet in length with professional captains and crews.

Yacht insurance from Chubb is available for pleasure cruisers at least 36 feet long (and valued up to $3 million), as well as captained yachts at least 70 feet long and valued at $3 million or more.

Among the niche yacht coverages available from Chubb are:

- Search and rescue

- Longshore and harbor workers’ compensation

- Boat show and demonstration

- Oil Pollution Act

Yacht insurance from Chubb can even include temporary substitute watercraft, so you can still enjoy the water if your yacht is damaged and requires repairs.

Coverage specifically designed for personal watercraft

Vessels are still covered during winter lay-up periods

Water sports liability coverage is included

No coverage for commercial use

$25,000 limit for no-fault medical payments

Specialty provider SkiSafe is one of the biggest personal watercraft insurers you’ve never heard of. The company doesn’t underwrite its own policies; that’s handled by AXIS Insurance Co., a large Bermuda-based insurer. SkiSafe has been around for nearly 50 years and insured more than half a million boaters.

Boat insurance from SkiSafe is designed to meet the needs of personal watercraft owners. As a result, coverages are fairly consolidated and focus specifically on the reduced needs of these types of boaters. Naturally, there is a heavy focus on coverage for injuries, including related to water sports. However, there are also special savings related to lay-ups, since the season for personal watercraft can be relatively short compared to other types of boats.

American Family »

Special coverage designed specifically for houseboats

Up to $100,000 of personal effects coverage available

Boats up to 54 feet can be covered (40 feet in Georgia)

A marine survey may be required

Must work with a local agent to buy coverage

American Family is unique among boat insurance carriers in that it’s one of few that offers a policy designed specifically for houseboats. Included in American Family houseboat policies are several coverages that cater specifically to these types of vessels, including up to $100,000 for your personal property in case items are stolen, damaged, or fall into the water.

Houseboat insurance from American Family may lack some coverages you might find with other types of vessels, such as emergency towing or parts delivery (these are included in some boat policies from American Family, but it’s unclear from the website whether they’re included in houseboat policies). Additionally, these policies have restrictions specific to houseboats, including horsepower limitations. But, American Family also offers unique discounts particularly helpful for houseboat owners.

Progressive »

Numerous discounts available

Can buy coverage online

Up to $1,000 of coverage if a pet is hurt or killed in a boating incident

Lots of limits on boat length and value

Many types of vessels are ineligible for coverage

Rounding out our list is insurance giant Progressive, which also has a strong boat insurance offering. Progressive has been insuring boats for more than three decades and insures more than 1 million vessels. Its policies should meet the needs of most owners of boats less than 50 feet long and worth less than $500,000.

Where Progressive really shines, though, is in its list of available discounts. Progressive offers boaters not just the standard discount opportunities available with other insurers, such as multi-policy, multi-boat, or paid-in-full discounts. Progressive also offers savings simply from switching coverage from another country. Additionally, accident forgiveness is also available for incidents both large and small.

The Bottom Line

Boat insurance is a highly individual product, much more so than auto or home insurance. Because boat owners’ needs vary greatly, it’s important to research providers to find the right carrier for your vessel and use case. Based on our research, we found that Geico is the best insurance company available for the widest array of vessels and the most common types of uses.

How to Find the Best Boat Insurance

Here are some essential tips to keep in mind when looking for the best boat insurance policy:

- Evaluate your coverage needs. Based on your boat's value, usage, and legal requirements, determine the type and level of coverage required.

- Compare quotes. Obtain quotes from multiple insurers to compare premiums, coverage options, and discounts.

- Review policy details. Carefully examine the policy's coverage limits, deductibles, exclusions, and additional benefits.

How to Save on Boat Insurance

When seeking to lower the cost of your boat insurance, consider:

- Maintaining a clean driving record. Even though you will be driving a boat and not a car, your record on the road can still be taken into account since many insurers link good driving with good boating.

- Improving your credit score. Maintaining a good credit score can also lower your premiums.

- Searching for discounts. Inquire about discounts, such as those for taking a boating course, being an experienced boater, or having outboard propulsion.

- Bundling policies. Save money by bundling your boat insurance with home or auto insurance policies.

- Raising deductibles. Opting for a higher deductible can lower your premiums, but ensure you can cover the out-of-pocket costs if you need to file a claim.

- Getting a marine survey. This will tell you how much your boat is worth, enabling you to get a more precise quote from your insurer.

- Making as few small claims as possible. Just like with other kinds of insurance, the more claims you make, the higher your premiums will be.

Do You Need Boat Insurance?

Whether you need boat insurance depends on various factors, including legal requirements and your personal circumstances. You should consider:

- State requirements. Some states require boat insurance, especially for larger or more powerful vessels. Check your state's regulations to determine if insurance is mandatory for your boat.

- Marina requirements. Many marinas require proof of insurance to dock your boat. This ensures you have coverage for potential damage to the marina or other boats.

- Protection. Boat insurance can cover a range of risks, including damage to your boat, liability for damages to a third party’s items, third party injuries, theft, and medical payments.

How We Chose the Best Boat Insurance

To identify the best boat insurance, we reviewed offerings available from numerous reputable carriers. We focused primarily on those with solid financial ratings and comprehensive coverage options to meet the needs of a wide array of boaters. We then narrowed down our selections to those providers with best-in-class offerings specifically designed to meet certain types of boaters.

WHY SHOULD YOU TRUST US?

At U.S. News 360 Reviews, our contributors and editors have years of experience researching and reviewing complex financial topics including insurance policies. Dock David Treece , the author of this piece and a senior contributor for 360 Reviews, has more than two decades of experience in the finance and insurance industry. He has covered insurance and other financial topics for Forbes, Investopedia, Business.com, and other publishers. He has also written for several insurers, including Progressive.

Boat insurance is not required in most states. However, if you have a loan secured by a boat, most lenders require that you buy boat insurance. Additionally, boat insurance can protect owners and operators against personal liability if they’re involved in an accident.

When you buy boat insurance, you’ll need to provide several pieces of personal information, as well as information about your boat and applicable licenses. Depending on the type of boat and policy, you may also be required to submit a marine survey, which assesses the condition of your vessel.

Boat insurance does not typically have a waiting period before you can file a claim.

Some insurers allow policyholders to insure multiple boats under the same policy, so long as they all have the same owner(s). Many carriers also offer discounts for owners who insure multiple boats with the same company.

Depending on the size, type, and value of the vessel being insured, some carriers require a boat to undergo an inspection (called a marine survey) in order to assess the boat’s condition prior to binding coverage.

The amount of boat insurance you need depends on your boat's value and how you plan to use it. It should cover your boat's replacement cost, and you should also consider purchasing liability coverage for accidents, medical payment coverage for injuries, and coverage for theft of personal belongings.

Homeowners insurance might offer limited coverage for small boats under certain circumstances, like damage caused by fire or theft while on your property. However, larger or high-performance boats typically require separate boat insurance for comprehensive coverage.

About Our Team

Dock Treece

Contributor

Stephen Yao , Ph.D.

Insurance Reviewer

U.S. News 360 Reviews takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

- Agent Directory

- Company Directory

Find an Independent Agent

- Get Matched with an Agent

- Agent Directory by State

Find an Insurance Company

- Get Matched with a Company

- Company Directory by State

What type of insurance do you need?

- Business Insurance

- Home, Auto & Personal Insurance

- Life & Annuities

By Coverage Type

- Commercial Auto Insurance

- Professional Liability Insurance

- Small Business Insurance

- Business Umbrella Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Business Owners Policy

- Builders Risk Insurance

- Cyber Liability Insurance

- Surety Business Bonds

- Inland Marine Insurance

- Employers Liability Insurance