- Sign Up (2)

Keep Up With Global Black News

Sign up to our newsletter to get the latest updates and events from the leading Afro-Diaspora publisher straight to your inbox.

- f2fafrica.com

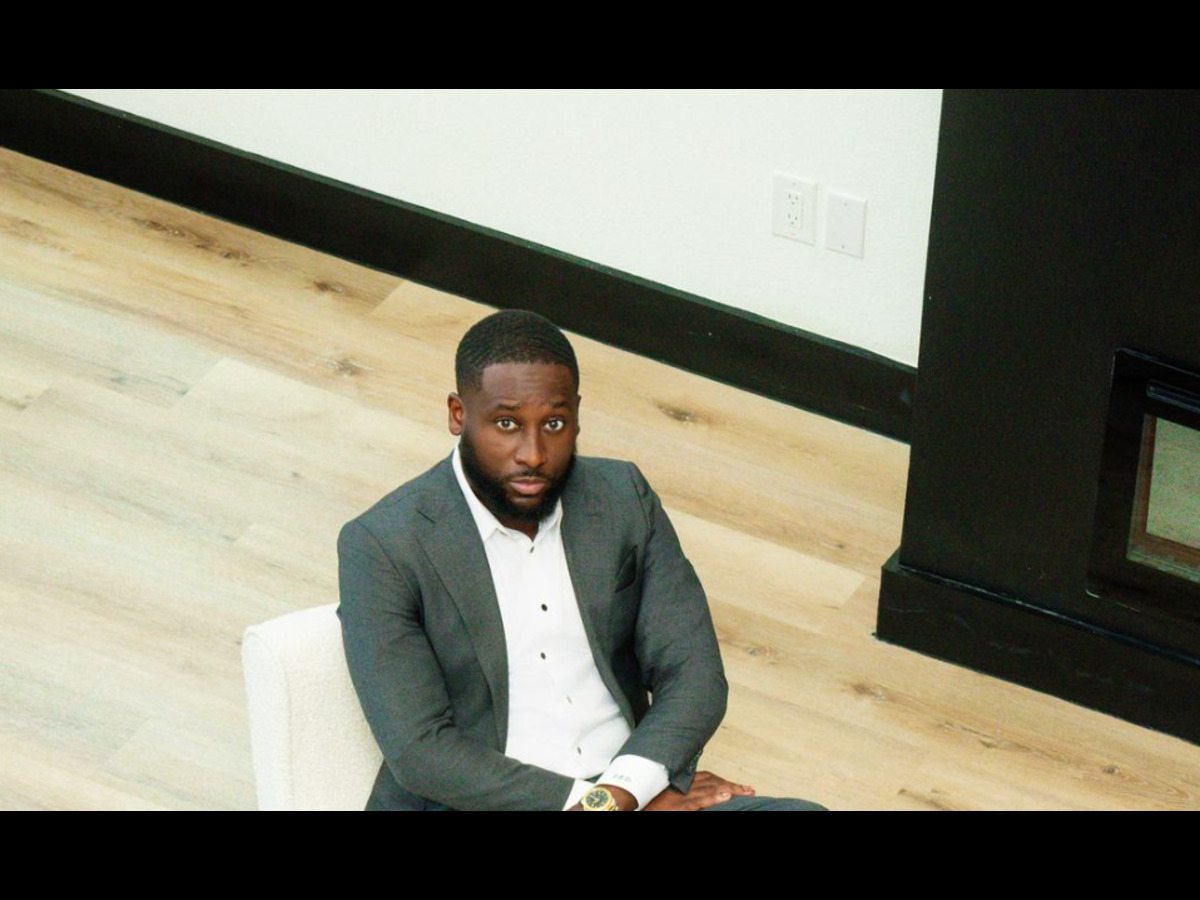

How the son of the surgeon who saved Martin Luther King built a 9 billion asset company

Meet Tracy Maitland, founder of a $9 billion asset company called Advent Capital Management , which he operates via email and Cisco videoconference calls.

The asset management firm has diversified into three synergistic business areas since its inception. It manages roughly $7 billion in long-only funds, primarily investing in convertibles, over $1 billion in three closed-end funds listed on the NYSE, and approximately $400 million in alternatives, including absolute return funds, hedge funds, and liquid alternatives, according to The Hedge Fund Journal .

Tracy is the son of Dr. Leo Cecil Maitland, one of the surgeons who operated on Dr. Martin Luther King Jr. at Harlem Hospital after he was stabbed at a book signing – while celebrating his narrative of the Montgomery bus boycott.

RELATED STORIES

How two Howard graduates started dorm room restaurant and got the Keith Lee stamp of approval

Deion Sanders' son Shedeur becomes first college football player to sign NIL deal with Nike

In 5 years, Kenyan HR and payroll startup Workpay has received nearly $10M in funding and now has the backing of Visa

Young Black real estate CEO who has developed millions of dollars in properties in Dallas shares how he did it

He decided to pursue finance instead of medicine, and his first job after graduating from Columbia University was at Merill Lynch; where he went through the ranks to lead the firm’s office in Detroit.

Raised in the Bronx, Tracy’s breakthrough came in 1985 when Merill Lynch invented a hybrid zero coupon bond that could be converted to cash or stock called “liquid yield option notes,” or LYONs.

Tracy became a top producer when LYONs became a big hit for Merrill Lynch . He made his big break while selling them to major clients like billionaire investor, Howard Marks, at the Trust Company of the West.

“Since the mid-1990s, his two largest strategies ($4 billion in assets), Advent Balanced Convertible and Advent Phoenix Convertible Income, have returned after fees, about as much as an S&P 500 Index fund, with less risk,” Forbes noted .

His success in Detroit resulted in him being recalled to Merrill Lynch’s New York offices in 1987. He was put in charge of convertible sales, a backwater at the firm, and led the unit to become the most profitable in the firm for several years.

He soon gained a reputation for weathering turbulent markets in 1995 with strategies ranging from defensive convertibles to riskier high-yield bonds and hedge funds. According to Forbes , each has returned between 7% and 8% annually since inception.

Today, Tracy is worth an estimated $250 million, and loads up on the convertibles of unleveraged technology and healthcare companies. His company’s buys include Massachusetts-based Akamai Technologies, which sells cloud infrastructure to web and streaming businesses; Workday, a Pleasanton, California-based payroll provider, among others, according to Forbes.

Conversations

Help us create more content like this

Subscribe to premium

Already a member? Sign in.

Connect with us

Join our Mailing List to Receive Updates

Symbol Matches

Symbol starts with, company matches.

- International

- Switzerland

| Not in the "Saddam has weapons of mass destruction" kind of way, but we did lay out some expectations that weren't met. Seven years ago FORTUNE identified a new crop of black power brokers on Wall Street. Ambitious, well connected, educated at elite schools, and trained at some of the Street's top firms, these entrepreneurs seemed to represent a shift in African-American power from political circles to financial ones. Not content to stay in the backwaters of municipal finance, where black firms typically dwelled, they charged into the flashier business of investment banking. We featured people like John Utendahl of Utendahl Capital Partners and Ron Blaylock of Blaylock & Partners, who forged strategic alliances with major brokerage firms. The group, we wrote, was creating a new vision of what minority-owned firms could accomplish on Wall Street. |

| |

But a look at who's wielding real power in 2004--based on balance sheets, performance figures, and deal flow--reveals a different outcome. What we expected to be a climb to the upper reaches of the investment-banking world by these players has been more of a slow crawl, with some dashed hopes by the wayside. Instead, among African Americans on the Street, it is those with quantitative expertise or unsexy niche specialties in finance and asset management who have posted the most significant gains.

We were indubitably right about one thing. Black power on Wall Street will never be the same. Dreaming big dreams, our group of pioneers shared the determination of the civil-rights generation's heirs to succeed independently in the mainstream--and to do so in spite of, not because of, their blackness. Their goal was to build companies that were not the best only in comparison with other black-owned firms but simply the best in their field. That isn't going to change.

But we were naive, perhaps, to suppose that having the right credentials and even access to deep coffers would be enough to successfully infiltrate America's largest white-male fraternity--Wall Street. That may sound like an odd statement considering that Merrill Lynch, the biggest firm on Wall Street, has a black CEO, Stan O'Neal. But climbing a corporate hierarchy and starting a business are two different things, and the people we're concerned with have been trying to do the latter. In fact, there is a new group of African-American entrepreneurs finding success on Wall Street (more on them in a minute), but they are mostly specialists with niche businesses. Success has remained elusive for black-owned firms trying to build full-service brokerages and general equity asset-management businesses.

The group we looked at had found a new model: accepting capital and backing from established Wall Street firms as a way to address the historical problem of black-owned firms having limited access to capital. Utendahl was the first. He partnered with Merrill Lynch, his former employer--before O'Neal got the top job there--which ponied up seed money of $3 million and a $9.9 million line of credit in return for 20% ownership stake. The alliance was supposed to help Utendahl land underwriting roles and give Merrill entry into business allocated to minority firms.

Ron Blaylock, who played ball with Patrick Ewing at Georgetown and later became a top trader at Paine Webber, followed suit. In 1993 he set up his own shop with the help of Bear Stearns, which invested $10 million for a 25% stake in the firm. Three years later Blaylock & Partners became the first minority-owned firm to lead-manage a corporate bond underwriting.

Not only was there a new model, but there were new areas of businesses like private equity funds. Fred Terrell left Credit Suisse First Boston, where he had become a managing director after 14 years, to start Provender Capital. Terrell's firm makes direct investments in companies and multi-unit franchise operations. Currently Provender's portfolio includes investments in Carver Bancorp, the largest black-owned bank, LeGourmet Chef, a specialty retailer of kitchenware and packaged gourmet foods, and Prestige Brands, which buys unwanted brands from corporate parents, including the purchase of Prell Shampoo, Chloraseptic, and Comet from Procter & Gamble.

But it was the investment-banking business that was viewed as leading the way. Today some argue that the firms were like handsome facades run by salesmen with limited management skills. "If you painted a lot of these firms white, they would have never been viewed as becoming so successful," says one black investment banker, who, like many interviewed for this story, requested anonymity.

Whatever the reason, black-owned investment banks haven't been able to solidify and maintain their position in one of the most select areas of Wall Street: the lucrative business of underwriting stocks and bonds for large corporations, where fees are a beefy 6% to 7% of the money raised.

In some cases early success has turned into a struggle to remain profitable in the sustained market downturn. In 2000, Utendahl suffered a $6 million loss according to financial statements filed with the SEC, driving the firm into a negative-capital status, an apparent violation of NASD requirements. At the crux of Utendahl's financial woes was a $12.9 million loan from Merrill Lynch that it could not repay. Sources close to the company say that Merrill forgave the loan to keep Utendahl from closing its doors. (Utendahl declined to be interviewed for this story.) In 2001 an unusual clause was buried in the text of one of Utendahl's underwriting deals. It assured that Deutsche Bank would make up for any deficiency in Utendahl's capital if necessary. Those words sent up a red flag telling the industry that the firm continued to have capital problems and raising questions about Utendahl's relationship with Merrill, since it was Deutsche Bank that was stepping in. A Merrill spokesperson says, "We have had a relationship with Utendahl and continue to maintain that relationship today," declining to comment further.

The bruising economy also put Blaylock on the ropes. Its profits plummeted 30% in 2002. Sources say Bear Stearns grew impatient with its investment and unwilling to sustain further declines. That same year the Rev. Jesse Jackson helped "negotiate" a buyout and cash infusion by the American Insurance Group with a total value of $27 million, according to sources. Bear Stearns declined to comment.

After a highly publicized hiring frenzy last year, scooping up well-known analysts laid off from major Wall Street firms, Blaylock has recently reversed course with massive layoffs and has shut down the brokerage's Chicago office. (Blaylock declined to be interviewed for this story.)

So what happened to our class of '97? Politics, race, greed, fear, missed opportunities, and in some cases self-sabotage all contributed to confounding expectations. Specifically, the political climate changed markedly, scandals soured the industry, and when the market went south, the Street's attitude toward inclusion and its patience for working with small firms went with it. Price also became critical. As small businesses, most of the black-owned firms couldn't compete on price because they didn't have the high volume to make it work. The firms also didn't have reserves fattened by the earlier stratospheric rise of stock prices. That boom was led by technology and Internet companies started by nerds in garages--not the sorts of relationships these firms had been pursuing. "We were starving at a table that was a feast," says Harold E. Doley, president of Doley Securities and the only black owner of a seat on the New York Stock Exchange. And while larger firms with beefier staffs had the expertise and resources to switch gears and chase the technology craze, black-owned firms were left on the sidelines. So when the market reversed course, the drubbing was severe.

For a fuller understanding, rewind to the late '90s, when political and economic factors created perfect conditions for black firms to thrive. Clinton and the Democrats were in office, and big business wanted to curry favor with Washington by supporting programs and initiatives established or supported by the government. The Resolution Trust--the government's thrift-bailout agency formed after the savings and loan crisis of the 1980s--dumped $20 billion of mortgage-backed securities on Wall Street, with a government mandate that 15% of it be set aside for minority-owned firms. Not only did this provide an instant business source, it also allowed black-owned firms to develop relationships with large institutional clients--the kinds of alliances they had little chance of cultivating on their own.

Their position was further bolstered in January 1997, when Jackson tossed the fear factor into the mix with the launch of his Wall Street Project, designed to help people of color get a fair shake. Jackson wielded considerable political influence at the time, as he began what he called the "civil-rights movement on Wall Street." And no company in America wants its name on the wrong side of a Jesse Jackson call-to-action catch phrase. Suddenly black firms had what they'd never had before--leverage.

But as the new millennium dawned, a strong wind of conservatism swept the nation. With Republicans in control of the White House and Congress, the business environment shifted. Jackson began to draw criticism for allegedly strong-arming companies to get black-owned firms included in deals. Jackson defends his actions. "It is not a shakedown, it's a shake up," he says. "And as citizens we have the right to participate in nonviolent avenues for change."

The change in political leadership began to take its toll. "People don't realize how significant Clinton was in fostering opportunities and how damaging the current administration is," says J. Donald Rice, president of Rice Financial Products. Corporations take their lead from the public sector, and diversifying opportunities in the securities industry was not high on the new administration's agenda.

Later the stock market hit a wall. Profits at the bulge-bracket behemoths slimmed down, with net income at Merrill Lynch plunging 85% in 2001. Although suffering losses is common, even expected, on Wall Street, it's a generally accepted fact among black entrepreneurs that their clients become skittish quicker than others. "At the first sign of problems they think you don't have the resources and capital to survive, so they say, Uh-oh, those doors are going to close, I'm out of here," explains one investment banker.

With deal flow drying up to a trickle, those companies still doing business were all about closing deals quickly without any hiccups or delays (remember the Utendahl clause). "They were struggling to be competitive against a wave of reduced appetite," says Robert Lamb, a professor at the Stern School of Business at New York University.

But it can't all be blamed on the market, George W. Bush, or unfair perceptions. Some of the problems were bad business decisions. Take, for example, the consolidation fever that spread through the banking and brokerage industry as companies saw a need to create scale by combining efforts. By and large the urge to merge never hit the black firms. Why? "It's mostly strong egos," says Lamb and many others who concur, "and a regional bias not to go into areas where they didn't really know anyone. Meanwhile the white firms were playing regional hopscotch all over the place."

Then of course there is the basic driving force of Wall Street--greed--to which black investment bankers were not immune. "Most of them didn't put the capital back into the firm," says one observer. "It went out the door via jets, expensive vacations, and all sorts of things."

On the asset-management side, lackluster markets proved particularly harmful to the black-owned firms doing traditional equity management. Many found their clients less willing to ride out the bumps with them. "Black firms haven't been around long enough to prove to the industry that they can survive downturns. The minute your performance numbers or your capital slips, there's a fear that you won't last, and some clients head for the door," says James Francis, CEO of Paradigm Asset Management. Francis's own firm lost $2 billion in assets in 1999, but it has been slowly coming back and now has $950 million.

As for the big plan for black asset managers to use minority set-aside allocations to build track records and then break into the mass market--well, it didn't pan out. "It was a deadly trap," says Quintin Primo, co-chairman of Capri Capital. The set-aside allocations are so minimal that black firms can't generate the kind of revenue that would allow them to add research, marketing, and other capabilities that would let them go after larger clients. "That's not a business--you're doomed to failure," Primo says.

If that weren't enough, black Wall Street, as a microcosm of the greater society, had its own share of CEOs behaving badly. Alan Bond, a 40-year-old Harvard Business School alumni and high-profile money manager who was a regular on Wall Street Week With Louis Rukeyser, is now serving a 12-year sentence in a New Jersey federal prison after being convicted on six counts of investment fraud. Through his former firm, Albiond Capital Management, Bond allegedly ran a cherry-picking scheme that allocated profitable trades to his own account and unprofitable trades into client accounts. Bond's tactic lost his clients $54 million, while his own account coincidentally ballooned an eye-popping 5,000%, to $5.5 million. While he was amassing a warehouse full of exotic cars and a lavish Florida home, Bond was also allegedly receiving $7 million in illegal kickbacks.

In March, a superceding indictment was handed down against Nathan Chapman, a personable money manager and president of Chapman Co. in Baltimore. Representing the Maryland pension system, he was a client of Bond. Chapman, who cut his teeth as the first and only black at Alex. Brown & Sons, was well connected politically and financially. He was chairman of the University System of Maryland's Board of Regents, and his company became the first publicly traded black-owned investment bank. Chapman boldly declared that he wanted to be to blacks what the Rothschilds and Morgans were to Europeans and Americans.

Instead, jury selection for his trial begins this month. According to Chapman's indictment, as Bond's business began to deteriorate under the weight of Bond's indictment, Chapman "compelled" Bond to buy shares of Chapman's own firm, eChapman, whose stock price was nearing loose-change levels. But the company did not meet the investment criteria for the pension fund at the time. According to Chapman's indictment, Bond did as Chapman wished, fearful of losing yet another client, and the state pension system lost $4.7 million. Chapman is also charged with stealing more than $518,000 from his firm and using some of the money to buy gifts for various women--none of whom was his wife.

The good news is that there are new black winners on Wall Street. Mostly new to us, that is--these companies have been around for years but are in arcane or unflashy businesses that don't get much media play. The power circle of 2004 is a niche gang. J. Donald Rice stands out among them. His ten-year-old firm, Rice Financial Products, is a specialist in the funky world of derivatives--financial instruments whose value depends on the characteristics of underlying assets or instruments. It's an industry so esoteric that even seasoned professionals occasionally admit to cluelessness. Not Rice, who earned an engineering degree from Kettering University and an MBA from Harvard Business School. He easily drifts into conversations about floating interest-rate swaps, structured securities, and other minutiae of financial engineering.

Rice's firm helps local governments and municipalities lower their borrowing costs when they sell bonds to raise money. Since opening its doors, Rice Financial Products has completed well over $20 billion in structured financial transactions, $7 billion in 2003 alone--executing the contracts itself and putting its own capital on the line, thereby reaping greater profits even in depressed markets. The privately held firm now sits on about $90 million in assets, Rice says.

If you think interest-rate swaps are unsexy, what about convertible bonds?

Meet Tracy Maitland, 43. Back in the go-go '90s when stocks garnered all the spotlight, Maitland was preaching his gospel of good defensive strategies, the value of convertible bonds, and protecting for the downturn. The former convertible salesman from Merrill Lynch didn't get much love. But his New York firm, Advent Capital Management, continued to land among the top convertible bond and high-yield asset managers, according to the Investor Force database. Over the past two years undying affection, in the form of $2 billion, has poured in from corporations, foundations, and high-net-worth individuals. Now Maitland, a Bronx native and a Columbia University alumnus, sits at the helm of a $3.6 billion asset-management business, which includes a closed-end mutual fund that trades on the New York Stock Exchange and a successful hedge fund. The hedge fund hasn't had a down year since its inception in 1996. And going after minority set-aside business is not part of Maitland's plan. "There's 98 cents in the majority bucket, and if you're lucky, 2 cents to share in the minority bucket," he says. "You do the math."

Christopher J. Williams, head of Williams Capital Group, uses the new model with a different approach--selling a 20% stake in his company to German banking powerhouse HypoVereinsbank, but taking a cue from the retail world with an intensive focus on customer service. The idea of keeping close and quickly responding to the needs of the customer may sound a bit touchy-feely for the investment-banking world, but Williams makes it work. For the past four years Williams's company has earned the distinction of being the only black-owned firm to land among the top 20 underwriters on Wall Street, according to Thomson Financial. This month Williams was elected to the board of Wal-Mart. Although Williams, who has an MBA from Dartmouth, has no technical specialty, he has been consistently profitable through down markets--setting himself apart from the rest of the investment-banking patch.

Among asset managers, specialties are also king. Daryl Carter, 48, and Quintin Primo, 49, co-chairmen of Capri Capital, built a $7 billion asset-management shop with offices in Chicago, Washington, D.C, San Francisco, and Irvine, Calif., by focusing on commercial real estate. The two were high school buddies but parted after graduation. Each got an MBA--Carter at MIT, Primo at Harvard. Carter joined Continental Bank, specializing in construction lending and workouts, and later Westinghouse Credit, where he headed the Western commercial real estate division in California. Primo joined Citicorp, now Citigroup, and by the mid-1980s was running its real estate investment-banking operations in the Midwest. Each started his own company, and both were crushed by the collapse of the real estate market. Being broke had a bonding effect, and the two decided to team up. They started a service to advise pension funds on how to invest in real estate, focusing on buying distressed loans at a discount from financial institutions. After a slow start they later bulked up with acquisitions, buying a mortgage-banking business and an equity-management arm. The company currently has a $5 billion real estate loan portfolio and collects management fees on properties valued at $2 billion.

All of these guys have done it right--building well-capitalized companies with proven track records and experience in troubled markets. And while we'll be watching their progress, we won't count out the fallen leaders either. For if one thing is clear, it's that the black-power movement on Wall Street still is a force that cannot be ignored. America's demographics are changing. Financial institutions are looking to woo the burgeoning middle and upper-middle class of African Americans. In real estate development and finance, urban centers are the final frontier. As Primo puts it, "Suburbia doesn't need another mall." To understand the financial and social dynamics of these areas, black-owned firms will be crucial. Then "cultural" expertise in dealmaking and finance will become a hot commodity on Wall Street. And that is true black power.

FEEDBACK [email protected]

| |

| |

NYC hedge fund CEO dismissed sexual harassment…

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on X (Opens in new window)

Daily News e-Edition

Evening e-Edition

- E-Newspaper

- National News

- Puzzles & Games

- Transportation

News New York News

Nyc hedge fund ceo dismissed sexual harassment as ‘locker-room talk,’ suit claims.

Courtney Robb charges in her suit filed Monday that she complained to Advent Capital CEO Tracy Maitland about a “rampant sexist environment” where men shamelessly commented on women’s looks and ranked their appearance. Another Advent employee allegedly said on the trading floor that Chelsea Clinton was a three “on her best day.”

But Maitland shrugged off a male colleague’s lewd comments as “locker-room talk” and told Robb she was “making some things into a bigger deal than they needed to be,” according to the suit filed in Manhattan Federal Court.

During the 2016 presidential campaign, President Trump infamously defended his comments about grabbing women by their genitals as “locker-room talk.”

When Robb started in 2016 as an investment associate maintaining client relationships, she says, she quickly learned that bros at the hedge fund played the juvenile game “f–k, marry, kill.”

One employee told Robb she was at “wife” status because of her reputation as an “uptight b—h,” according to the suit.

Chelsea Clinton was ranked in the game because the hedge fund was in the same Midtown office building as the Clinton Foundation, according to the suit.

Maitland had little sympathy for Robb after she sounded the alarm about the workplace harassment, according to the suit.

“What do you want me to do? Hire more women? They just end up leaving to take care of kids!” Maitland allegedly said.

Robb claims she was fired shortly after voicing her complaints.

“While Advent cannot comment on pending litigation, we believe that the complaint does not fairly or accurately recount the facts of this matter. This is plaintiff’s third law firm in three years,” an Advent spokesman said.

“Advent is proud of its commitment to a culture free of harassment and being a strong advocate of civil rights organizations nationally.”

Advent has an ongoing lawsuit against Robb for alleged theft of proprietary information. Robb’s attorney Jeanne Christensen said the charge was baseless.

“This case demonstrates that #MeToo still has many miles to go on Wall Street. Female employees continue to be silenced in this male-dominated sector. We look forward to holding Advent Capital accountable for its brutal retaliation and unlawful conduct,” Christensen said.

More in News

National News | Former Miss Teen USA contestant slams JD Vance for bullying

National News | Trump promises to uphold Florida abortion ban following conservative backlash

National News | Drunk driver accused in Johnny Gaudreau’s death ordered to remain behind bars

Movies | Bombshell Trump biopic ‘The Apprentice’ to be released ahead of election

Tracy-and-the-Maiden-crew

- Inspiration

Related News

Popular news this week, popular news this month, latest news.

- Yacht Charter & Superyacht News >

Written by Rachel Kelly

This image is featured as part of the article The International SeaKeepers Society, sailing yacht MAIDEN and Seabed 2030 collaborate during the 2023/24 Ocean Globe Race .

Please contact CharterWorld - the luxury yacht charter specialist - for more on superyacht news item "Tracy-and-the-Maiden-crew".

- Charity & Fund Raising

- CharterWorld News

- Classic Yachts

- Coronavirus

- Cruise Ship

- Ecological Yachts

- Expedition Yachts

- Expert Broker Advice

- Feature Superyachts

- Interior Design

- Legal & VAT Yacht Issues

- Luxury Catamarans

- Luxury Gulet

- Luxury Phinisi

- Luxury Trimarans

- Luxury Yacht Design

- Luxury Yachts

- Marinas & Harbours

- Marine Ecology

- Marine Electronics

- Marine Equipment

- Mega Yachts

- Modern Yachts

- Motor Yachts

- New Launch Yachts

- New To Charter

- Open Style Sports Yachts

- Private Jets

- Sailing Yachts

- Social Media

- Sports Yachts

- Superyacht Crew

- Superyacht Photographers

- Superyacht Products & Supplies

- Superyacht Refits

- Superyacht Reviews

- Superyachts

- Uncategorized

- Yacht Builders

- Yacht Charter

- Yacht Charter Destinations

- Yacht Charter Picks

- Yacht Charter Specials

- Yacht Delivered to Owner

- Yacht Designers

- Yacht Events & Boat Shows

- Yacht Fashion

- Yacht Industry News

- Yacht Photos

- Yacht Racing

- Yacht Racing & Regattas

- Yacht Safety Equipment

- Yacht Support Vessels

- Yacht Tenders

- Yacht Videos

- Yachting Associations

- Yachting Awards

- Yachting Business

- Yachts For Charter

- Yachts For Sale

Quick Enquiry

Superyacht news:.

Email Your Yachting News to: news @ charterworld.com

Sailing Yacht MARIQUITA v. Charter Yacht ELEONORA match race raises £67,000 for disabled sailing charity Wetwheels

San Fernando Race 2011

ISS’s Annual UK Regatta Raises £5550 for Sail 4 Cancer

The International SeaKeepers Society celebrated its 25th anniversary with an event at the Fort Lauderdale International Boatshow (FLIBS)

55m superyacht YN20555 is launched by Heesen Yachts and named superyacht SERENA

Van der Valk Shipyard announce 35m explorer yacht SAMBA

Abeking & Rasmussen’s 41-meter superyacht NURJA relaunched after refit

Aegean Yachts unveil 26m explorer yacht HEKATE

OCEA delivers 33m motor yacht ARAOK II to her new owner

39m sailing yacht LINNEA AURORA launched by SES Yachts

A luxury charter yacht is the perfect way to encounter New England’s fall foliage display

Charter yachts offering citizen science opportunities around the world

A first look at 55m superyacht PROJECT AGNETHA from Heesen Yachts

Late summer special offer on board 72m superyacht ARBEMA in the Western Mediterranean

44m superyacht ORION ONE reaches a construction milestone

44m charter yacht JEMS offers 9 days for the price of 7 in August in Italy

A $9 Billion Wall Street Heavyweight Talks Racism And How To Build A Better Society

Walk into Tracy Maitland’s midtown Manhattan corner office and his perch resembles the classic Wall Street seat of power. It possesses key features like sweeping views of Central Park from atop a 57th street skyscraper, and Maitland’s desk is crowded with statues and lucite tombstones commemorating successful offerings for his $9 billion in assets investment firm, Advent Capital Management.

A few other things catch the eye, however. There’s the framed photograph of his father, Leo, just after he and a team of surgeons at Harlem Hospital saved Dr. Martin Luther King Jr.’s life when he was stabbed at a book signing in 1958. Behind Maitland’s desk are pictures of his family with President Obama and the First Lady on the campaign trail, and during the two-term Obama presidency. There are photographs of Maitland’s dogs, a Cane Corso, Kenya, and two Olde English Bulldogges, Bailey and Tucker. Maitland was motivated to become a long-serving board member of the A.S.P.C.A. after Atlanta Falcons quarterback Michael Vick was jailed for being part of a dog fighting ring, hoping to represent African Americans and build community ties.

Maitland is one of the most influential African American financiers on Wall Street and a champion of racial equality in the predominantly caucasian industry. Advent is a powerhouse in the niche market of investing in convertible bonds, and Maitland is the firm’s principal owner. Some 55% of Advent’s staff are women and minorities, and Maitland, a graduate of Columbia University, prioritizes recruiting analysts from New York City’s working class schools like Baruch College. With excess profits, the firm endows cultural institutions like the Apollo Theater in Harlem, and the local hospital where his father worked. About three years ago, Maitland became a financial backer of the New York Police Department’s efforts at neighborhood policing, a program to build ties between police and the minority communities they serve, which has now been rolled out to every precinct in the city.

Maitland is also candid, willing to speak his mind after the United States was roiled by a racist incident in Central Park in late May. Then, protests swept the nation into June after an unarmed black man was killed by police in Minnesota during an arrest.

“What happened with Amy Cooper in Central Park when she tried to weaponize race and gender against Christian Cooper is telling of the challenges and institutionalized racism in this country,” Maitland tells Forbes . “She did it because she thought she could,” he says of the incident, in which a black man asked a white woman to leash her dog in a protected part of Central Park and she called the police presenting Mr. Cooper as a threat.

Amy Cooper later said in a statement , “I want to apologize to Chris Cooper for my actions when I encountered him in Central Park yesterday. I reacted emotionally and made false assumptions about his intentions when, in fact, I was the one who was acting inappropriately by not having my dog on a leash....I hope that a few mortifying seconds in a lifetime of forty years will not define me in his eyes and that he will accept my sincere apology.”

Then there was the killing of George Floyd in Minnesota, in which a police officer used unnecessary restraining force against Mr. Floyd, who later died in custody. “The symbolism of that police officer's knee on George Floyd’s neck was very powerful emotionally,” Maitland notes, “It basically says, I'm in control as if I'm a king and I can kill you, or let you live, on a whim.”

Since, the police officers involved have been charged criminally and the country has been swept in protests. The vast majority were peaceful. However, some turned violent, and cities like New York and Los Angeles have seen looting. Police have reportedly been injured, thousands have reportedly been arrested nationwide. Some mayors and governors instituted curfews in response. In Washington, President Trump called in the military, which then used tear gas on a protest to clear a way for a photo opportunity. On Wednesday evening, Trump was sharply criticized by his former Secretary of Defense James Mattis for those theatrics. “Donald Trump is the first president in my lifetime who does not try to unite the American people—does not even pretend to try,” wrote Mattis in a letter.

For Maitland, the events of May and June go beyond politics. They are important in surfacing long-simmering issues of race, justice, and fairness in America. “George Floyd could have been me,” says Maitland, “Society has to be aware that this is real. It’s a real risk to African American men.”

After the disturbing incidents, there’s new motivation for change. Foremost, is an urgent need to expand fairness and equal opportunity for minorities, according to Maitland. “The great thing about America is it is a country of immigrants. When people come, they come with their best ideas,” he says, repeating the country’s motto “E pluribus unum,” latin for “out of many, one.”

“This nation is the United States,” he says. “But if we are going to be united, everyone has to have equal access and full and fair consideration.” For many protesters, the issues go beyond just police tactics. “These people don't have access to great education, great health care, or economic opportunity,” he says, “And so they've had enough. They're looking for a way to get fairness in a society that promises a doctrine of equal opportunity.”

Maitland broke through on Wall Street in the early 1980s interning at firms like Bear Stearns while studying at Columbia, and then was trained in Merrill Lynch’s analyst program. After becoming a top salesperson at Merrill, Maitland founded Advent in 1995 and built it into one of the largest minority-owned investment firms in the world. For most of his career, Maitland says he’s seen opportunity for minorities recede at the highest rungs of finance.

“I believe there is something called invisible affirmative action,” says Maitland. People hire those they know, or are those who are referred by family, friends and affinity groups. “I understand it. It's comfortable and it’s the easy thing to do,” he says. “There are less African Americans on Wall Street than there were when I was in the middle of my career....If you want to have a productive society, you have to encourage participation from all parts.”

The path forward, according to Maitland, is hard-minded work at widening the doors of opportunity in business and finance to those who are currently shut out, whether that’s African Americans, or other underrepresented minorities like women and hispanics. The first step, according to Maitland, is for companies to truly hold themselves accountable to concrete goals of having a diverse workforce.

Corporations need to begin laying out specific targets for diversity in their workforce, their managerial ranks, and their boardrooms, he argues, and it’s crucial that bonuses, stock options, and other compensation are tied to actually hitting them. “Companies need to be measured on whether they are making progress,” Maitland says, “It’s good for business, and it’s good for this country.”

In finance, the potential for change is even greater. Maitland believes banks and investment firms can make far greater investments in minority-owned businesses and underrepresented communities, where investment capital can compound opportunity. Diverse companies, hire diverse workers and they can become beacons in their own communities. The world is awash in money, but it barely trickles into minority businesses.

Change is afoot. On Tuesday morning, Bank of America unveiled a $1 billion commitment to support minority communities by working with historically black colleges and universities, hiring more workers from underrepresented communities, job training and investment in local businesses and affordable housing. “The events of the past week have created a sense of true urgency that has arisen across our nation, particularly in view of the racial injustices we have seen in the communities where we work and live,” said BofA CEO Brian Moynihan, in a statement. “We all need to do more.”

With Covid-19 pummeling the economy, Maitland notes that scores of cultural institutions are at great financial risk and could close their doors without help. Three days ago, Advent announced a $100,000 donation to the iconic Apollo Theater in Harlem to help safeguard its future. It also earmarked $50,000 in medical equipment for Harlem Hospital, where his father worked, and Meharry Medical College in Tennessee.

Other giants in investment management, like Robert Smith’s Vista Equity Partners and Frank Baker’s Siris Capital have recently made important grants to minority communities, targeting education, opportunity, and financial access .

“It is incumbent on companies like ours to help support diverse communities,” says Maitland, “If it’s not for that, what are we here for?”

This artilce originally appeared on Forbes .

Pacer ETFs’ COWZ: Revolutionizing Value Investing with Free Cash Flow Yield

Fed compelled to pivot from gradual rate cut approach, expect a trump victory to rattle the credit markets, ubs says, why kamala harris's approach to capital gains is generating so much controversy, jpmorgan chase faces lawsuit over interest payments on uninvested cash.

- More Articles

Musk Beats Suit Over Promoting Dogecoin ‘Pyramid Scheme’

Elon Musk and Tesla won dismissal of a lawsuit claiming they pumped up the price of the cryptocurrency Dogecoin into a $258 billion “pyramid scheme.

Traders See Fed Delivering 25 bps Cut In Sept, 100 bps By Year-End

Traders added to bets that the Federal Reserve will start U.S. interest-rate cuts next month with a quarter-point reduction in the policy rate.

A 360 View: How Advent Capital embraces convertibles as market hedge

Advent President and Chief Investment Officer Tracy Maitland sat down with Alternatives Watch to discuss Advent’s 360-degree view of the credit marketplace and the strong opportunity set for convertible bonds. Noting their positive asymmetry, Maitland makes the case for convertibles in a volatile and challenging economic environment.

If you have questions or require additional information please contact Advent Capital.

Click here .

Advent Disclaimer

This page contains certain additional regulatory and other disclosures applicable to Advent Capital Management, LLC and its subsidiaries and affiliates (collectively, “Advent”). Not An Offer Of Advisory Services Or Securities This website (“Site”) is limited to the dissemination of general information about the services provided by Advent. This Site and the reports, data, information, content, software, RSS and podcast feeds, products, services, and other materials on, generated by or obtained from this Site, whether through links or otherwise (such material, together with this Site, the “Content”) does not constitute and should not be construed as an offering of advisory services or an offer to sell or a solicitation to buy any securities or related financial instruments in any jurisdiction. The Content is for informational purposes only and should not be considered as a recommendation of any particular security, strategy or investment product. No investment advice, financial advice, tax advice, or legal advice is provided through the Content, and no person is authorized to use the Content for those purposes. Any discussion or information in the Content relating to investment processes, portfolio characteristics or other matters relating to Advent, an Advent investment strategy and/or an Advent-managed separate account or collective investment vehicle (collectively, an “account”) is subject to change over time. Opinions and any forecasts of future events, returns or results that are expressed in the Content reflect the opinion of the author, are subject to change without notice, do not reflect actual investment results and are not guarantees of future events, returns or results. Responses to any inquiry that may involve the rendering of personalized investment advice or effecting or attempting to effect transactions in securities will not be made by Advent absent compliance with applicable laws or regulations (including broker dealer, investment adviser or applicable agent or representative registration requirements), or applicable exemptions or exclusions therefrom. Offerings are made only to persons who are "accredited investors" as defined in Rule 501(a) under the Securities Act of 1933, as amended. General Risk Warnings Past performance does not guarantee, and is not a reliable indicator of, future results and the performance of an account may be substantially different. Current performance may be lower or higher than performance shown in the Content. The performance of an Advent investment strategy or account may be volatile, and an investor could lose all or a substantial portion of any investment made in an Advent investment strategy or account. No representation is given that an Advent investment strategy or account is suitable for any particular investor. Market conditions can fluctuate and vary widely over time and can result in a loss of portfolio value. Advent makes no guarantee or representation that any Advent investment strategy or account will achieve its investment objective or have positive returns. Investing in financial markets involves a substantial degree of risk and there can be no guarantee that the investment objectives of an Advent investment strategy or account will be achieved. Returns presented on a gross basis are substantially higher than returns presented on a net basis because gross returns do not reflect the deduction of investment advisory fees and other expenses that would be incurred by a client. The returns of a client investment in any investment strategy will be reduced by the advisory fees and any other expenses it may incur in the management of its account. Advisory fees have a compounded effect in reducing account performance over time. The Content may contain certain forward-looking statements. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances. Actual outcomes and results may differ materially from any outcomes or results expressed or implied by such forward-thinking statements. The success or achievement of various results, targets and objectives is dependent upon a multitude of factors, many of which are beyond the control of Advent. Although Advent-generated Content has been prepared using sources, models and data that Advent believes to be reasonably reliable, its accuracy, completeness or suitability cannot be guaranteed and should not be relied upon as such by any person. The information contained in the Content does not purport to cover all matters that may be relevant for the purposes of considering whether or not to make any prospective investment. Prospective investors should conduct their own investigations in relation to the matters referred to in the Content and are recommended to consult their own advisers in relation to such matters. Revised January 2018 Advent Capital Management, LLC © 1995–2018 Advent Capital Management, LLC All rights reserved. Your use of this site signifies that you accept our terms & conditions of use.

Recent news

05.12.2023 News Room

Tracy V. Maitland received an honorary Doctorate of Humane Letters from Virginia Union University

04.03.2023 News Room

The win-win case for convertibles

01.31.2023 News Room

Marc Aylett’s high yield market insights featured in Bloomberg

United states.

888 Seventh Avenue, 31st Floor New York, NY 10019

+1 212 482 1600

+1 888 5 ADVENT

United Kingdom

4th Floor Devonshire House 1 Mayfair Place, London W1J 8AJ

Please leave your details below and a member of our team will contact you, answer any questions, and get you started.

Tracy Maitland

IMDbPro Starmeter See rank

- Contact info

- Founder of Advent Capital Management, LLC

Related news

Contribute to this page.

- Learn more about contributing

More to explore

Recently viewed.

IMAGES

VIDEO

COMMENTS

Tracy Maitland, 59, operates his $9 billion (assets) investment firm via email and Cisco videoconference calls. His task this morning is to navigate a trading day in which the Dow Jones Industrial ...

Tracy is the son of Dr. Leo Cecil Maitland, one of the surgeons who operated on Dr. Martin Luther King Jr. at Harlem Hospital after he was stabbed at a book signing - while celebrating his ...

Walk into Tracy Maitland's midtown Manhattan corner office and his perch resembles the classic Wall Street seat of power. It possesses key features like sweeping views of Central Park from atop ...

Tracy V. Maitland '82CC is the founder, president, and chief investment officer of Advent Capital Management, LLC, an investment firm that manages over $9 Bi...

Tracy Maitland. Net worth: $150 million. Source of wealth: Investments. Residence: New York City. Age: 48. Bronx native attended Columbia University, nabbed job in convertible securities ...

In late March 2017, after Robb brought her concerns to the firm's chief operating officer, the firm's founder, Tracy Maitland, allegedly called her into his office and closed the door.

Browse 121 tracy maitland photos and images available, or start a new search to explore more photos and images. Whitney W. Donhauser, Tracy V. Maitland and James G. Dinan attend the Museum of the City of New York Chairman's Leadership Award Dinner on June 6,...

Sitting here at Tracy's with Penny Watson and Maddi - here is the next step in helping Tracy.....Cloverash Horse Floats are commencing building a float for Trac! ... Tracy Maitland and her family deserve all the help that they can get! 5. 12y. 12 years ago. Amanda Danielle Hodge. That is awesome every little bit helps . 2. 12y. 12 years ago ...

Meet Tracy Maitland, 43. Back in the go-go '90s when stocks garnered all the spotlight, Maitland was preaching his gospel of good defensive strategies, the value of convertible bonds, and ...

TRACY MAITLAND, Advent Capital, Founder and CEO. Moderated by EDWARD LEWIS, Essence Magazine, Founder "Control your own destiny." On June 14, 2018, in Manhattan, ICON MANN and Ogilvy partnered for a very special evening of conversation and fellowship with President and CEO of Advent Capital TRACY MAITLAND.

Tracy Maitland, Advent President & CIO, chats with Barron's about how convertible bond issuance is still booming in 2021. Read more here. Advent Disclaimer. This page contains certain additional regulatory and other disclosures applicable to Advent Capital Management, LLC and its subsidiaries and affiliates (collectively, "Advent").

NEW YORK, NY - APRIL 19: (L-R) Tracy Maitland, Sherri Rosen, Cathy Wallach, and Larry Rosen attend the 21st Annual Bergh Ball hosted by the ASPCA at The Plaza Hotel on April 19, 2018 in New York ...

Tracy Edwards on an inspiring journey as her iconic yacht maiden sets sail for one last adventure. After defying odds in the Whitbread race, Maiden is making...

Skippered by British sailor Tracy Edwards, Maiden became the first all-female crew to sail around the world in 1990 - a landmark moment for a sport that was slow to welcome women into the fold.

Korolyov is a mid-sized city in North Moscow Oblast, best known as the "cradle of space exporation," as it was the center of the Soviet space program. It was also a former elite dacha location, a vacation spot for all sorts of famous Russians. Photo: Grishinia, CC BY-SA 4.0. Photo: Qweasdqwe, CC BY-SA 3.0. Ukraine is facing shortages in its ...

This image is featured as part of the article The International SeaKeepers Society, sailing yacht MAIDEN and Seabed 2030 collaborate during the 2023/24 Ocean Globe Race.

Walk into Tracy Maitland's midtown Manhattan corner office and his perch resembles the classic Wall Street seat of power. It possesses key features like sweeping views of Central Park from atop a 57th street skyscraper, and Maitland's desk is crowded with statues and lucite tombstones commemorating successful offerings for his $9 billion in assets investment firm, Advent Capital Management.

Advent President and Chief Investment Officer Tracy Maitland sat down with Alternatives Watch to discuss Advent's 360-degree view of the credit marketplace and the strong opportunity set for convertible bonds. Noting their positive asymmetry, Maitland makes the case for convertibles in a volatile and challenging economic environment.

Tracy Maitland. Self: The Black Godfather. Menu. Movies. Release Calendar Top 250 Movies Most Popular Movies Browse Movies by Genre Top Box Office Showtimes & Tickets Movie News India Movie Spotlight. TV Shows. What's on TV & Streaming Top 250 TV Shows Most Popular TV Shows Browse TV Shows by Genre TV News.

Airport information about UUMV - Vatulino [Vatulino Airport], MOS, RU

Korolyov or Korolev (Russian: Королёв, IPA: [kərɐˈlʲɵf]) is an industrial city in Moscow Oblast, Russia, well known as the cradle of Soviet and Russian space exploration.As of the 2010 Census, its population was 183,402, the largest as a science city. [4] As of 2018, the population was more than 222,000 people. It was known as Kaliningrad (Калинингра́д) from 1938 to ...

Hourly Local Weather Forecast, weather conditions, precipitation, dew point, humidity, wind from Weather.com and The Weather Channel